A few nights before the election, my wife and I were out for a walk with our Jack-a-Bee. The topic of the presidency came up. Our conversation went something like this:

Lien, my wife: Hilary is going to win the election.

Me: I wouldn’t be so sure.

Lien: All the polls show Hilary is in the lead.

Me: One thing I’ve learned from studying the stock market is that predictions are notoriously wrong.

Sure enough, Election Day has come and gone – with all the pollsters and forecasters left scratching their heads. For all their analysis, they could not accurately predict what was to come. Predictors of the stock market usually fare no better.

How to Invest During the Trump Presidency

What will the stock market do under the new president? One could argue that Trump’s anti-establishment approach will frighten investors, creating massive market volatility. One could further back-up this claim by pointing to entertaining studies that measure stock market performance relative to Democratic vs. Republican presidencies. Apparently, Democrats are better for investors.

As appealing as the idea is to base your investment strategy off of the presidential incumbent, using predictions doesn’t really work. So, if we can’t accurately predict the impact of a Trump presidency on the stock market – what should an investor do? The answer is actually the same as any and all current events: Do nothing. Stay the course. Ignore your investments. Don’t check your account balances every minute.

What Matters in Investing

When it comes to investing, you need to focus on the things you can control – as emphasized by the multi-trillion dollar investment company Vanguard Group. And it goes without saying that you can’t control who the president is – but you can control:

- Costs

Fees eat away at your investment returns. Each time you pay money to an investment manager, you have less money to invest. Keep your costs low and your investments will grow quicker.

- asset allocation (for risk tolerance and diversification)

Choose the appropriate investments given your appetite for risk – and choose different types of investments to decrease your risk.

- taxes (asset location & low-turn over)

Strategically place those investments with poor tax treatment in tax-advantaged accounts and choose passive investment funds that don’t generate a huge tax bill.

How Reacting to the President-Elect will Decrease your Investment Return

Making a strategy change in light of the new president flies in the face of what constitutes a proven investment strategy. And there are consequences for doing so. Were you to make any investment decisions on the basis of a new president (or otherwise), you’d be engaging in market timing – which most investors are not able to successfully execute. Why not?

- Costs

Every time you make a move in your investment portfolio, you’re paying fees (and possibly taxes). Even if you’re using commission-free stocks or ETFs, you’re still paying a bid/ask spread (or your mutual fund manager is paying that fee on your behalf). If you’re dealing with a taxable account, you’ll be realizing capital gains – which can be more than 50% for some tax brackets when including state taxes.

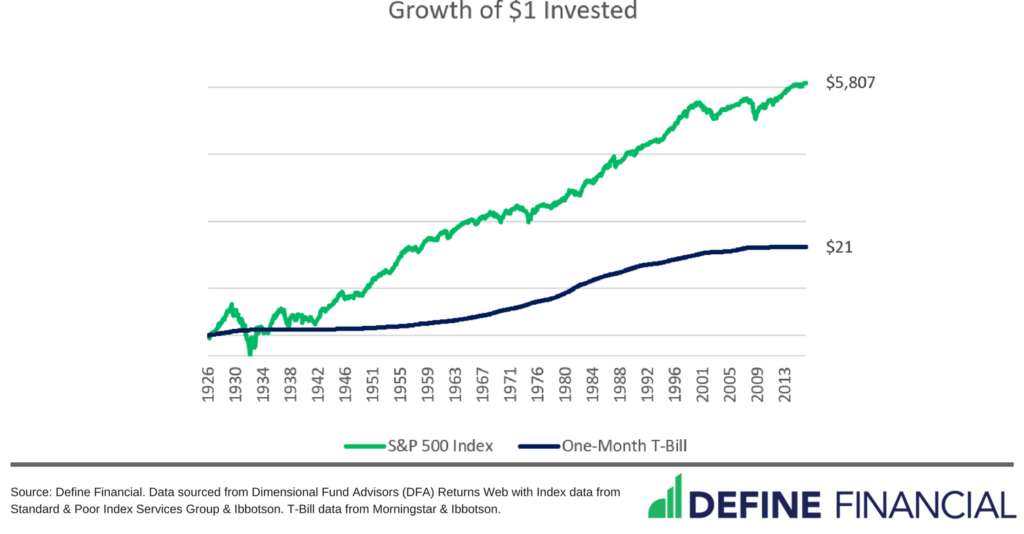

Market Timing into cash also means you’re moving away from your initial stock/bond mix. The long-term consequence will be that you won’t be able to reach your financial goals given the low investment return available on cash.

In short, market timing in response to current events (be it the elections, or anything else) is a bad move. What’s the best investment move for a Trump presidency given that all market predictions are notoriously wrong? Do nothing.