Recently, we completed a financial plan for a young professional (we’ll call him Adam). I’m happy to say that Adam was on a good track.

He was maxing out his 401(k) each year and held small taxable and Roth IRA accounts as well. Prospects were bright for Adam: at his savings rate, the retirement he wanted in the future was a definite possibility.

This, of course, assumes that everything goes according to plan. But what if it doesn’t?

While Adam did a great job saving and investing his income, there two massive holes in his financial plan. Two holes that, if left unaddressed, could completely derail all of his hard work.

Key Takeaways

-

Disability insurance protects your income if you can’t work due to illness or injury

-

Umbrella insurance gives you extra liability coverage in case something really expensive goes wrong

-

Both policies help protect your future income and financial security, especially early in your career

What May Happen If You Skip Disability Insurance

What’s the problem? To start, Adam didn’t have any disability insurance. He didn’t even have a not-so-great policy offered through his employer.

He had absolutely nothing.

In the event that Adam was to become disabled and unable to work — and therefore not earn the income he needed to achieve his financial goals — he would be in a pretty bad situation.

But that’s a situation that he could probably avoid by having a robust disability insurance policy in place.

Disability insurance replaces your income when you can’t work. Be it from an accident or illness, disability insurance is very valuable because it keeps a paycheck coming in from the insurance company when the paycheck from your employer stops.

Disability Insurance Protects Your Most Valuable Asset: You

When you’re in your working years, your most valuable asset is yourself. That includes your future earning potential. You have a lifetime of future paychecks in front of you. That means that there are millions of dollars of future paychecks at stake.

When it comes to using insurance the right way, we want to use insurance to protect us from the really big financial losses. This means using insurance to help protect your future salary.

Getting a private disability insurance policy does take some time to set up. But it’s worth it, and all young professionals need to have a private disability insurance policy because there’s so much of your money on the line.

But, don’t just take my word for it. Consumer expert Clark Howard has the following to say about the issue:

There’s no downside to an umbrella insurance policy.

Should You Get Umbrella Insurance Policy?

The next thing Adam missed is Umbrella Insurance. Umbrella coverage is a type of insurance policy. The umbrella policy provides additional coverage (in terms of the dollar amount) over your existing insurance policies.

This coverage increases the liability protection to your automobile and homeowner’s insurance. Umbrella insurance can sometimes cover personal watercraft as well (like a jet ski, bass boat, etc.).

How Does Umbrella Insurance Work?

Umbrella insurance increases your liability protection on your automobile insurance and your homeowner’s insurance. So, if you crash into someone or something with your car, your umbrella policy can step in to increase your protection. The same goes for homeowner’s / renter’s insurance. If someone is injured on your property (be it inside or outside your home), your umbrella policy can step in to increase your liability protection.

To illustrate how an umbrella insurance policy works, I’ll use a hypothetical example using Joe Danger, CPA:

Partie McPartnerstien, a partner at the Big Four, is turning into the parking garage for yet another day at the office. Partie, a Ferrari aficionado, is driving his limited edition F70. Halfway into the turn, Joe Danger comes screaming around the corner in his Toyota Corolla and slams right into the side of Partie’s Ferrari.

In this situation, Joe is liable for the complete destruction of the Ferrari. Unfortunately for Joe, the Ferrari is valued at $1,000,000.

What’s worse, Joe’s auto insurance coverage only provides up to $300,000 in damages. This leaves Joe personally liable for the balance of $700,000 for the damaged Ferarri.

Fortunately, Joe opted for an umbrella policy. For the price of just a few hundred bucks a year, Joe has coverage of up to $1,000,000. Since Joe has $1,000,000 in coverage, the umbrella policy pays the $700,000 owed to Partie.

Maintaining an umbrella policy protects you from extreme financial losses – like destroying someone’s expensive property or injuring someone.

Use Umbrella Insurance with Your Existing Insurance Policies

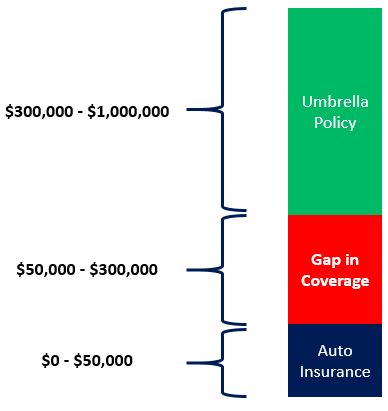

You’ll want to max out your liability coverage on both your automobile insurance and your homeowner’s/renter’s insurance and then purchase umbrella insurance. If you don’t max out the liability protection on your existing insurance policies, you’ll likely create a gap in your liability coverage. Consider the following example:

Having learned his lesson from the Ferrari incident, Joe Danger purchases an umbrella policy extending his liability coverage to $1,000,000. The umbrella policy starts providing protection at $300,000. (Technically, you could call this a $300,000 deductible on an umbrella policy.) Since, Joe Danger feels assured he’s protected given his $1,000,000 in umbrella coverage – Joe decides to skimp on his automobile insurance coverage. Joe decreases his coverage on his automobile policy to down to $25,000/$50,000. Or said another way, Joe’s auto policy will now only pay out a maximum of $50,000 in the event he crashes his car into someone or something.

Is Joe protected? Absolutely not! There is a $250,000 gap in Joe’s insurance protection. So, while Joe’s auto insurance will cover Joe between $0 and $50,000, and his umbrella policy will cover him between $300,000 and $1,000,000, he has no coverage between $50,000 and $300,000. In short, Joe could very likely be on the hook for a quarter of a million dollars.

LTD and Umbrella Protect Future Paychecks

Just like a long-term disability policy, umbrella insurance protects the most valuable asset of young professionals: future paychecks. How does that work?

Let’s say Joe Danger ended up being liable in the example above. His future wages could be garnished to pay for the damage.

The same could happen to you without the appropriate umbrella insurance coverage. It’s important to get a policy — but while you may be able to get umbrella insurance from your employer, you may not want to.

How Much Umbrella Insurance Do You Need?

If you’re a retiree, you want umbrella coverage roughly the equivalent of your naked assets. That’s anything you own that doesn’t receive special protection from creditors. Certain investments accounts, like a 401(k) account, receive special creditor protection.

Getting more umbrella coverage never hurts, either (except that you’ll be paying a bit more for insurance).

For retirees, I’d be hard-pressed to say that you don’t need more than your naked assets’ value in umbrella coverage. But, just because you have a net worth of $1 million, that doesn’t necessarily mean that you couldn’t face a judgment of more than $1 million.

Of course, the likelihood of facing a judgment (especially one that large) is very small. But that’s exactly how insurance is supposed to be used: protecting you from the small possibility of a big loss!

Let’s get back to young professionals for a moment, though. What sort of umbrella insurance do you need at that stage of life? Whatever your future earning potential is. If you’re making $100,000 a year now, with 20 years of work ahead of you, consider at least $2,000,000 in umbrella policy coverage. Of course, you can always buy more coverage if that makes you feel more comfortable.

Critical, But Missed by Most Young Professionals

So, now you know:

- When you’re working, your most valuable asset is yourself and your ability to earn an income.

- Disability insurance can protect that asset.

- Umbrella insurance can help ensure all your other policies will provide enough protection in a worst-case scenario.

Make sure you have both a robust disability insurance policy and a sizeable umbrella insurance policy to protect yourself!

Taylor Schulte, CFP® is the founder & CEO of Define Financial, a fee-only wealth management firm in San Diego, CA specializing in retirement planning for people over age 50. Schulte is a regular contributor to Kiplinger and his commentary is regularly featured in publications such as The Wall Street Journal, CNBC, Forbes, Bloomberg, and the San Diego Business Journal.