Today I’m talking about the best investment benchmark…inflation!

Why?

Inflation reduces the value of your hard-earned money every day. In other words, one dollar today, is not worth one dollar tomorrow.

By stuffing your money under the mattress (or in a savings account earning 0.001%), you are guaranteeing a negative real return.

Since inflation is so hurtful, we need to keep a watchful eye on it. If we don’t, it can easily destroy our hard-earned wealth and put our retirement plan in jeopardy.

So if you want to learn how to use inflation as an investment benchmark, you’re going to love today’s article.

What Is an Investment Benchmark?

A benchmark is a point of comparison, or a tool we can use to create a frame of reference. This helps us evaluate the performance of our investments.

At Define Financial, we monitor inflation by using it as our investment benchmark on performance reports. This allows us to compare the real value of our client’s money yesterday, today, and tomorrow.

How do benchmarks work?

Consider a benchmark in your life. For example, you might be a runner who knows that the average person runs a mile in ~12 minutes. That information can be used as a benchmark to evaluate your run time. .

Now let’s talk about benchmarks in terms of how they relate to investing. Specifically, what is it like to invest without a benchmark?

Imagine you bought some shares of stock in Facebook, Tesla, Netflix, Google, or anything else fun and interesting.

Over time, the price of your stock went up. Maybe you made a few hundred dollars. Maybe you made a few thousand. Either way, you’re pretty excited because you made some money.

Good for you!

But, what’s your benchmark? What is your point of comparison? What could you have done in the same amount of time? Was there a better alternative?

Did you actually lose money compared to another, better investment? How can you even answer the question?

When you invest without a benchmark, you can’t answer these important questions.

Investment Benchmarks to Keep in Mind

If you’ve ever received an account statement on the performance of your investments, you’ve likely seen a benchmark before.

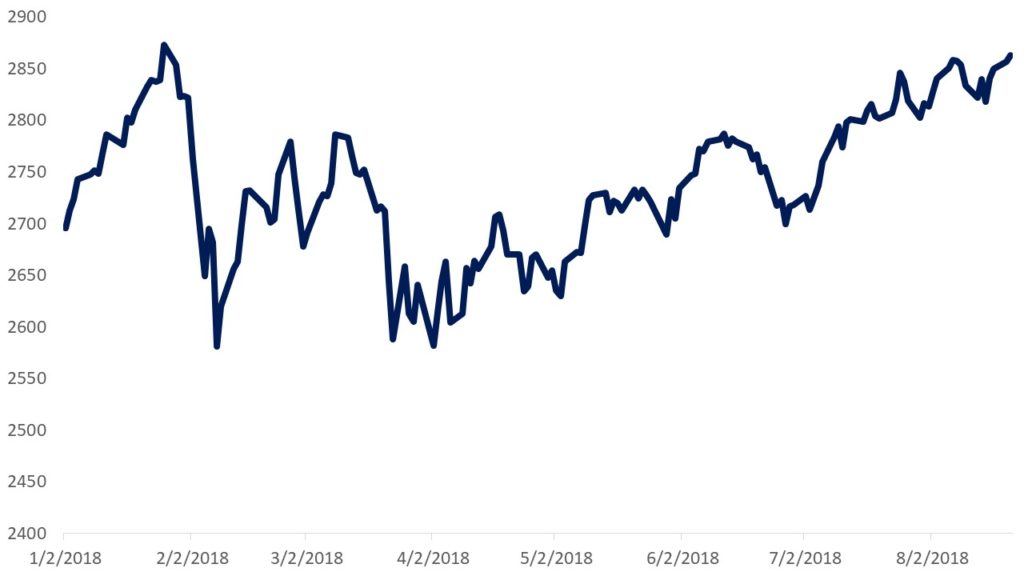

One very common investment benchmark is the Standard & Poor’s 500 Index. The S&P 500 contains a broad mix of U.S. stocks of large companies.

As a result, looking at the S&P 500 can tell you the investment performance of those 500 large U.S. companies.

The S&P 500 is a very common investment benchmark.

Of course, there are other benchmarks besides the S&P 500 that track the performance of various markets.

There are benchmarks for stocks of large companies trading in the United States, like the Dow Jones Industrial Average.

There are also benchmarks for stocks of companies in international countries, like MSCI EAFE.

And there are even benchmarks for junk bonds, commodities, and real estate.

How the Use of Benchmarks Has Changed Over Time

A long time ago, financial planning wasn’t a thing. The idea that you could plan out your life and optimize your finances to achieve your personal goals didn’t exist.

In place of financial advisors, there were professionals known as “money managers” or “investment managers.” These people would take your money and, if they didn’t screw up too badly, turn it into even more money.

Of course, it’s difficult to measure whether an investment manager screws up or not without a point of comparison.

Enter investment benchmarks.

Stock and bond benchmarks were used to judge the performance of an investment manager. Given that the focus was so narrow, using an investing benchmark (such as the S&P 500) made sense.

The other reason benchmarks were used is more complex.

At the time benchmarks were first popularized, investment managers weren’t just trying to grow wealth to keep up with inflation and match the market. They touted their ability to “beat the market” or help you earn a better return than the masses were earning overall.

Of course, over time, it became evident that these investment managers could not beat the market. It was also determined that investment managers didn’t determine investor return as much as the cost of investing did.

As a result, savvy investors have largely moved into low-cost investments today. If you can match the benchmark and keep your investing costs extremely low, you can do well in today’s investing environment.

The Bottom Line

These days, personal finance has become much more sophisticated than investing alone. Instead of looking at just one piece of your life (your investments), financial planners are able to look at everything in your life that involves money.

This includes things like:

- Managing risk using the right type of insurance

- Estate planning to make sure that your money has a plan in your absence

- Tax planning so you don’t overpay the IRS

- Retirement planning to help make work optional

- College planning

- Cash flow and expense tracking

As financial advisors started helping their clients manage more than just investments, the way that we look at investments has changed, too.

Investing is no longer only about making the most money possible. Investing has become about managing risk and knowing you won’t run out of money in retirement.

With all of this in mind, it’s smart to use inflation as your point of comparison when you look at your investments.

Why?

Because the S&P 500 (or any other investment benchmark) has little to do with how you are going to be able to achieve retirement, nor can it tell you if you’re on track to accomplish what you want in life.

Your money will have less purchasing power in the future. However, you can use that knowledge to your advantage.

By keeping track of inflation with respect to your investments, you can ensure you’ll have the cash you need to reach your lifestyle goals in retirement.