Today I’m sharing how the new Inherited IRA Rules might stick your retirement account beneficiaries with a large tax bill.

In fact, if your family trust is a beneficiary on any of your retirement accounts, the new tax law could cost your loved ones dearly.

If you want to understand what to look for and how to avoid a costly mistake with your retirement beneficiaries, you’re going to enjoy this post.

More of a visual learner? Check out the short video I recorded on this topic:

The SECURE Act went into effect on January 1, 2020.

It’s the first significant change to the US Tax Code since the Tax Cut and Jobs Act of 2017.

For the most part, recent changes under The SECURE Act are favorable to taxpayers. For example:

- Required Minimum Distributions (RMDs) now begin at age 72

- IRA Contributions Beyond age 70 ½

- Expanded use for 529 College Savings Plans

The change you might be concerned about:

- Elimination of the Stretch IRA for beneficiaries

Let’s look at why this concerning change is important and how to make sure you are protecting your beneficiaries.

First, What Were the Old Inherited IRA Rules?

If you inherited a retirement account prior to 2020 from a person who was taking Required Minimum Distributions (RMDs), you were required to continue taking RMDs the first year after inheritance.

Let’s use Roger as an example of how the old Inherited IRA Rules worked:

Roger is 45-years old.

His 80-year-old mother passed away in 2019 and he inherited her Traditional IRA.

Because she was 80 years old, she was taking RMDs from her IRA.

Since Roger inherited her IRA, he will be required to continue his own beneficiary RMDs next year (2020) and beyond.

In Roger’s case, his own RMDs were calculated and stretched out over his remaining life expectancy.

This was commonly referred to as a Stretch IRA and it allowed the beneficiary to better control the annual tax bill.

What are the New 2020 Inherited IRA Rules and How Does it Impact Beneficiaries?

There are two major changes under the new SECURE Act rules in 2020 and beyond:

- Unlike Roger (above), Inherited IRA account owners are not required to take Required Minimum Distributions.

- Inherited IRA account balances must be fully withdrawn within ten years of inheritance.

While a beneficiary isn’t required to continue RMDs, he/she can no longer stretch out distributions and control the tax obligations over their lifetime.

The entire account balance must be withdrawn – and taxes must be paid – within ten years of inheritance.

Do all Beneficiaries Lose the Stretch IRA?

Like many other answers involving the subject of taxes and finances, it depends.

The IRS allows the following beneficiaries to still benefit from the Stretch IRA in 2020 and beyond:

- The surviving spouse

- Individuals who are not more than 10 years younger than the original owner

- Minor children, not grandchildren, then 10-year rule becomes effective no later than age 26

- Disabled and/or chronically ill beneficiaries

- Beneficiaries of annuity contracts in which an irrevocable income election is already in place.

- Beneficiaries of inherited Government-sponsored retirement plans until Jan 1, 2022

How Do I Know if the New Inherited IRA Rules Affect My Beneficiaries?

You may be thinking…

“So what? I’ll just follow the new tax rules like everyone else and be on my way.”

Because the new rules replace decades-old tax code, many trusts contain outdated language.

This outdated language could cause significant troubles for your beneficiaries.

If your family trust is the beneficiary for any of your retirement accounts, you need to review the document for the following language about distributions:

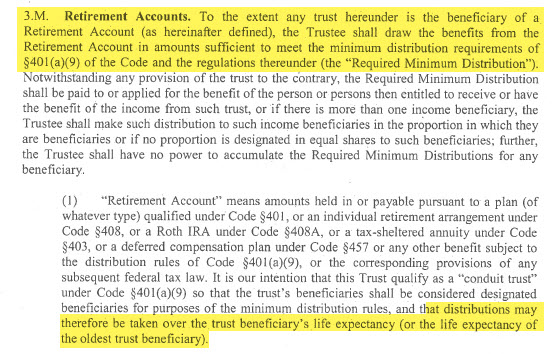

“…the Trustee shall draw the benefits from the Retirement Account in amounts sufficient to meet the minimum distribution requirements of 401(a)(9)…”

Below is a real-life example from a trust. The language in this example poses a significant estate planning problem if left unchecked.

In this example, the Trustee is directed to only disburse the minimum amount required.

Since the new tax rules don’t require RMDs to continue, the “minimum annual amount required” is technically $0 until the end of the tenth year.

At the end of the tenth year, the entire IRA balance is required to be withdrawn.

In other words, your beneficiary wouldn’t receive any money until the tenth year if your trust contains the above-referenced language.

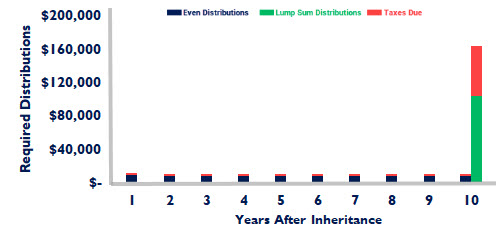

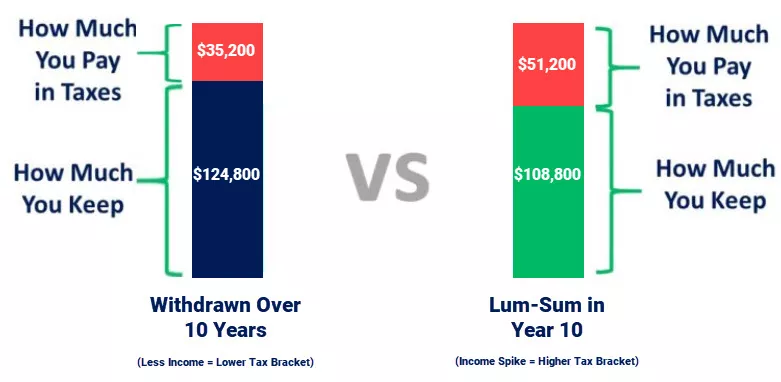

For illustrative purposes only to show the difference of withdrawing even amounts each year vs. a lump sum in Year ten

For illustrative purposes only to show the difference of withdrawing even amounts each year vs. a lump sum in Year ten

This scenario can create a couple of issues:

- Liquidity: Your beneficiaries may not have access to cash to fund their needs after you’re dead. In the example above, the Trustee’s hands are tied and can’t allow your heir(s) to touch their inheritance for ten years.

- Taxes: Your beneficiaries will be forced to take a lump-sum distribution during the tenth year. This can cause an income spike, push them into a higher tax bracket, and increase the chunk of cash the government will take.

- Tax Planning: Your beneficiaries can’t spread the tax obligation out over ten years or accelerate it in a low-income year. They lose the ability to take advantage of tax planning.

For illustrative purposes only. Assuming withdrawals in even amounts over ten years at 22% vs. a lump sum in year ten at a 32% Tax Rate

For illustrative purposes only. Assuming withdrawals in even amounts over ten years at 22% vs. a lump sum in year ten at a 32% Tax Rate

How Do I Fix This?

I bet you can guess I’m going to tell you to consult your estate attorney and financial planner.

If you find your trust contains problematic language, and the new rules do not align with your estate plan’s intentions, work with your trusted advisors to amend your trust.

Amending your trust does come at a cost. If it’s not the right time for you to spend hundreds (or thousands) of dollars, there’s an alternative to consider.

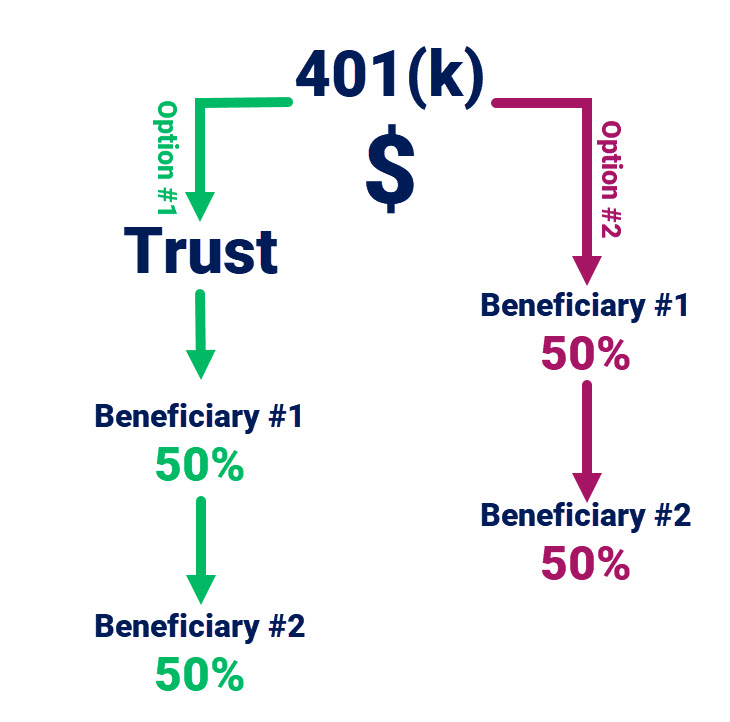

You can call your financial institution (or trusted financial advisor) and request to name individual beneficiaries — in place of your trust — for your retirement accounts.

For example, let’s say your trust splits assets 50/50 between two beneficiaries.

Instead of naming your trust as a beneficiary, you could simply name the two individuals as beneficiaries on your IRA and indicate the 50/50 split.

This will accomplish a similar outcome and does not require you to update your trust.

As a reminder, the beneficiary designation on your retirement accounts supersedes the instructions in a trust. (Disclaimer: There are unique circumstances where this might not be true. Check with your attorney and/or financial advisor to confirm.)

What Should I Do If I’m Unsure About the New Inherited IRA Rules in 2020?

Trust documents are complicated to read. It’s understandable if you’re confused about how the new Inherited IRA rules affect your estate plan.

A simple solution is to contact your estate attorney or financial planner and ask them these two questions:

- Is my trust named as the beneficiary on any of my retirement accounts?

- Do the SECURE Act’s new Inherited IRA rules affect my beneficiary’s ability to access my retirement account assets at my death?

Your trusted advisor(s) should be very familiar with this topic. He/She has likely already worked with a number of their clients to find an appropriate solution.

Now that you have a better understanding of the new Inherited IRA rules under the SECURE Act, the time to take action is now!

For illustrative purposes only to show the difference of withdrawing even amounts each year vs. a lump sum in Year ten

For illustrative purposes only to show the difference of withdrawing even amounts each year vs. a lump sum in Year ten For illustrative purposes only. Assuming withdrawals in even amounts over ten years at 22% vs. a lump sum in year ten at a 32% Tax Rate

For illustrative purposes only. Assuming withdrawals in even amounts over ten years at 22% vs. a lump sum in year ten at a 32% Tax Rate