The current global pandemic certainly has spun our lives around.

I’m taking COVID-19 very seriously, doing my best with social distancing and preventing any potential spread of the disease.

But I miss seeing my dad. I do wonder, “would hanging out together be worth the risk?” Even though we’ve been following the guidelines, I know our good behavior is not enough to justify a visit.

My wife and I don’t feel sick, but we could be asymptomatic carriers.

So, let’s argue that the chances are small – but still exist – that I could give my dad coronavirus. The possibility is more than zero, and I’m not too fond of those odds.

As a financial planner, I look at the numbers. I evaluate life choices in terms of risk and return. And I think spending quality in-person time with pops right now is not a good deal in terms of risk and return.

Risk and Return

We recently had the chance to perform annual reviews with some of our clients, checking up on their financial plans.

Did the clients do their homework – be it meeting with an attorney to create a will, increasing their 401(K) contribution to the maximum allowable, or updating their homeowner’s insurance coverage?

Of course, given the recent stock market volatility, investment portfolios were discussed, pushing the less exciting – bonds – into the spotlight. (Normally, folks don’t get too interested in bonds. Stocks are where the action is.)

Bonds are the underwear in your portfolio — unexciting and not much thought about, but select the wrong pair and you’ll be surprised at just how uncomfortable you are. ~William J. Bernstein

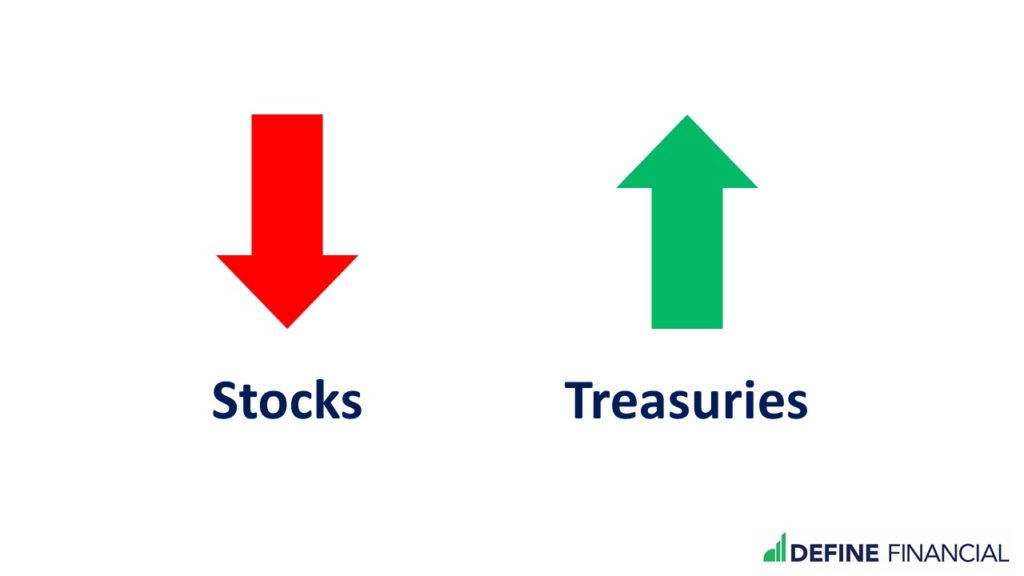

We were able to talk about the bonds we use in our clients’ portfolios (Treasury bonds), and how they performed during March’s COVID-inspired stock market rout. (Treasury bonds increased in value.)

But, not all bonds do that. For the most part, only U.S. Treasury bonds increase in value when U.S. stocks do poorly. And, you likely don’t need me to tell you that’s something you want your bonds to do.

That’s portfolio diversification at work.

U.S. Treasury bonds tend to increase in value when U.S. stocks decline.

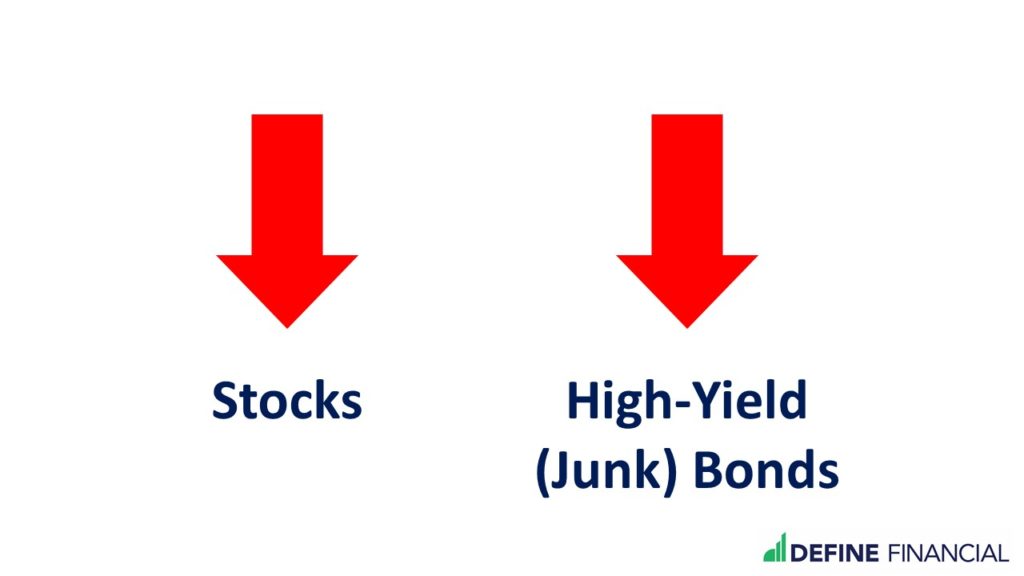

The alternative is that your bonds don’t move in value at all, or lose value when the stock market drops. That begs the question: who would want bonds that do the same things as stocks?

Anyone “reaching for yield.”

The Best Bonds Have the Least Credit Risk

In Uncut Gems, Adam Sandler plays a gemstone dealer with a gambling problem. He uses money that isn’t his to play the odds. Throughout the movie, Sandler’s character collects a growing list of people to whom he owes money.

Sandler’s character is an excellent example of high credit risk. Credit risk is the chance you won’t receive repayment for money lent.

Of course, you don’t have to lend your money to something so risky as a compulsive gambler. Instead, you could lend it to a highly-rated publicly-traded corporation, such as Enron.

Enron was once rated as a very safe place to lend your money; we all know how that story ended. (Enron filed for bankruptcy.)

Theoretically, Enron shouldn’t have been a high credit risk. The credit rating companies said so. But, the credit rating companies are often wrong.

What if you don’t like credit risk?

You can lend your money to the United States government. You do this by purchasing U.S. Treasuries, individually or through a mutual fund or ETF. With the U.S. government, you get what is arguably the least amount of credit risk – compared to other borrowers.

If you can imagine a circumstance where the U.S. government can’t repay it’s debt, getting your Treasury bond interest payments will likely be the least of your concerns.

Reaching for Yield Pushes You from the Best Bonds

Why would anyone lend money to someone other than the U.S. government – especially if there’s a chance they won’t be paid back? It’s all about the money.

Even though U.S. Treasuries are safe, they pay very little interest. That’s the price of safety. At Define Financial, we think that’s a fair trade-off.

When it comes to the safe part of your portfolio (the bonds), we want it to offer you security. We don’t want an investment portfolio’s bonds to be the mostly-safe part, because we wanted the bonds to pay a little bit more.

If you choose to go with corporate or municipal bonds, there is a gamble you won’t get all your money back – and a very real chance your bonds will lose value at the exact time your stocks do.

Lower-rated bonds, like high-yield (junk) bonds, frequently lose value when U.S. stocks do.

Consider the Worst-Case Scenario to Answer Which Bonds are Best

A former co-worker of mine says I always look at the worst-case scenario, and he’s right. Earning a little less interest is way better than having a bond default entirely. I’d rather have clients miss out on a bit of interest than lose everything.

The same goes for hanging out with dad. I’m just fine postponing hanging out to ensure his well-being. For me, the cost of not seeing him in person is worth it. And for now, we can Zoom.