Why should you consider college savings plans?

$440,223! That’s why!

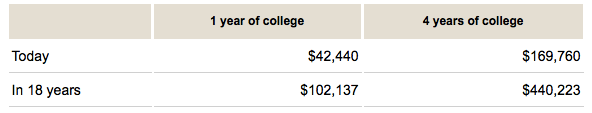

$440,223 is the estimated cost to send my unborn child to my alma mater – The University of Arizona – in 18 years. It’s also close to the median home price in San Diego.

Here, see for yourself and share in my misery:

Powered by Wealth Management Systems, Inc.

Yes, this assumes that the cost of college will continue to increase by an average of 5% per year. And yes, this assumes that I will be paying out-of-state tuition. But any way you slice it, college is expensive.

Now, do I really believe that I will be paying almost one-half of a million dollars to send my child to college in 18 years? No. But that’s another conversation.

I do believe, however, that most parents are underprepared for the cost of higher education. In my experience, they don’t start saving early enough, they don’t have an automated savings plan guiding them to their goal, and most importantly, they don’t always take advantage of the most tax-efficient savings vehicles.

Before you start to panic, remember that you don’t have to fund the full amount. Many families save only a portion of the projected costs and then use it as a “down payment” on the college bill, similar to the down payment on a home.

If you are ready to start saving for college – or you would like to improve your current savings plan – here are three vehicles for you to consider utilizing:

529 PLANS

Under a special rule, up to $70,000 ($140,000 for married couples) can be contributed to a 529 plan at one time without incurring gift taxes. In many states, your contributions are deductible on your state income tax return, too.

Similar to a Roth IRA or 401(k), any earnings in the account are deferred from federal, and in most cases, state taxes. Best of all, as long as the funds are used for qualified college expenses, withdrawals from the account are tax-free!

Potential tax deduction + tax-deferred growth + tax-free withdrawal = More $$$ for college!

Keep in mind, if your child does not attend college and you withdraw the funds for another purpose, earnings will be taxed and a 10 percent penalty will be imposed. However, 529 rules allow you to change the beneficiary once per year. So, if “child A” doesn’t use the funds, you can utilize them for “child B” or another qualifying member of the family.

COVERDELL EDUCATION SAVINGS ACCOUNTS (ESA)

A Coverdell ESA is a tax-advantaged savings vehicle that lets you contribute up to $2,000 per year. The tax benefits are similar to a 529 but the ESA allows you to use the money for K-12 qualified expenses in addition to college. Although you have complete control over the investments in the account, Coverdell ESAs are not revocable. Distributions from the account are always paid to the beneficiary and cannot be paid back to you.

Coverdell ESAs have a number of limitations and nuances, so be sure to do your homework before jumping in headfirst.

UTMA/UGMA CUSTODIAL ACCOUNTS

A custodial account is a way for your child to hold assets in his/her name with you acting as the account owner until they reach a designated age – typically 18 or 21. All contributions are irrevocable and earnings and capital gains generated by investments in the account are taxed to the child each year.

Assets in the account can be used for college but they don’t have to be. Often times, parents or grandparents will fund a custodian account to give the child flexibility when they turn of age. On the other hand, some are reluctant to use these accounts because they are concerned the child might use the funds in an irresponsible manner.

We are all well aware of the rising costs of education. One easy way to help boost your savings is to consider participating in a program like Upromise – a rewards program that directly benefits the college savings vehicle of your choice. Visit upromise.com for more information.

Please note, some college savings plans may impact financial aid eligibility. Additionally, account fees vary from plan to plan, and if too high, can hinder your savings goals. Consult with your trusted advisor(s) to choose a plan that is right for you.