In this article, I’m sharing the top questions to ask a financial advisor in 2025.

I’m also sharing how to choose a financial advisor.

Hiring an advisor is one of the BIGGEST financial decisions you’ll ever make. And one wrong recommendation (from the wrong advisor!) can crush your retirement plan.

So, if you want to learn how to choose a financial advisor and what questions to ask, you’ll love this article.

Key Takeaways

- There are 300,000+ financial professionals in the U.S. Without any legal standardization of titles or designations, it’s difficult for people to know how to choose a financial advisor.

- Knowing the top questions to ask a financial advisor can help you properly evaluate different professionals and hire the right one for your needs.

- The best financial advisors will be patient during the interview process and prepared to respectfully answer all of your questions.

How to Choose a Financial Advisor

With over 300,000 financial professionals in the U.S., knowing how to choose a financial advisor is challenging.

One of the biggest contributors to this challenge is that financial advisors are NOT required to use a consistent title.

For example, you might encounter titles such as: certified financial planner, wealth advisor, investment manager, and financial consultant.

While they might all seem similar, these titles don’t provide insight into what the advisor actually does. Unlike doctors and attorneys, there is no legal standardization of titles and no clear definition for investors to lean on.

In fact, a mortgage broker could call themselves a financial planner! 😲

3-Step Process For Choosing An Advisor

To help you with this challenge, here are three simple steps explaining how to choose the best financial advisor for YOUR needs:

- Document Your Big Questions and Pain Points. For example, do you want to know when you can retire? How to reduce taxes? Or are you just starting your financial journey and need help establishing a long-term plan?

- Learn About the Different Types of Financial Advisors. Each type of advisor has a different service model and fee structure. Your specific needs and pain points—coupled with your personal preferences—will help you identify the right type of advisor for you.

- Interview and Evaluate 3-5 of the Best Financial Advisors. The best financial advisors will display patience during the interview and welcome your hard-hitting questions. They should also provide a detailed process to help you further evaluate them.

Bonus Tip: Before officially hiring a financial advisor, review their professional background for infractions, client complaints, felonies, and more. You can quickly do this at no cost at BrokerCheck and the Investment Advisor Public Disclosure (IAPD) website.

In summary, when you set out to choose a financial advisor, you cannot rely solely on their professional title. It’s meaningless and sometimes deceptive.

Instead, use the 3-step process above as a starting point for choosing the best financial advisor for your needs. Most importantly, take your time making one of the most important decisions in your financial life.

7 Questions to Ask a Financial Advisor

While most people can document their financial goals and research different types of advisors, very few investors know EXACTLY what questions to ask.

To do my part to help, here are the top 7 questions I suggest asking a financial advisor.👇

1. Are You a Fiduciary (100% Of the Time)?

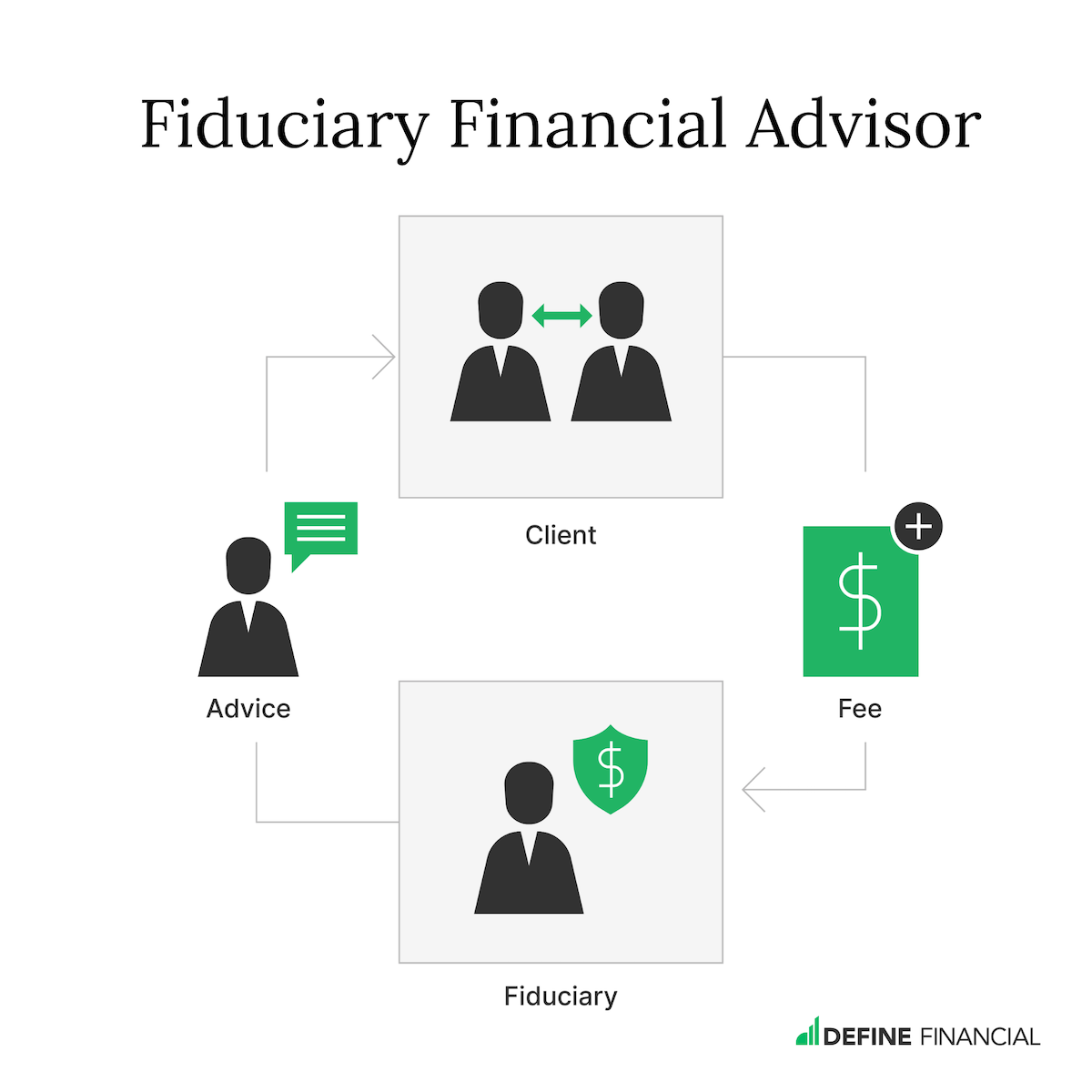

A fiduciary financial advisor is legally required to put your interest first.

A fiduciary is also prohibited from selling you a financial product (e.g., annuity, mutual fund) in return for a commission.

Their compensation must come directly from you (the client) and be a transparent line item on your statement.

If you want your interests to be ahead of anything (and anyone) else, it’s critical to ask an advisor you’re interviewing the following question:

“Are you a fiduciary 100% of the time?”

Unfortunately, most of the responses will be, “No!”

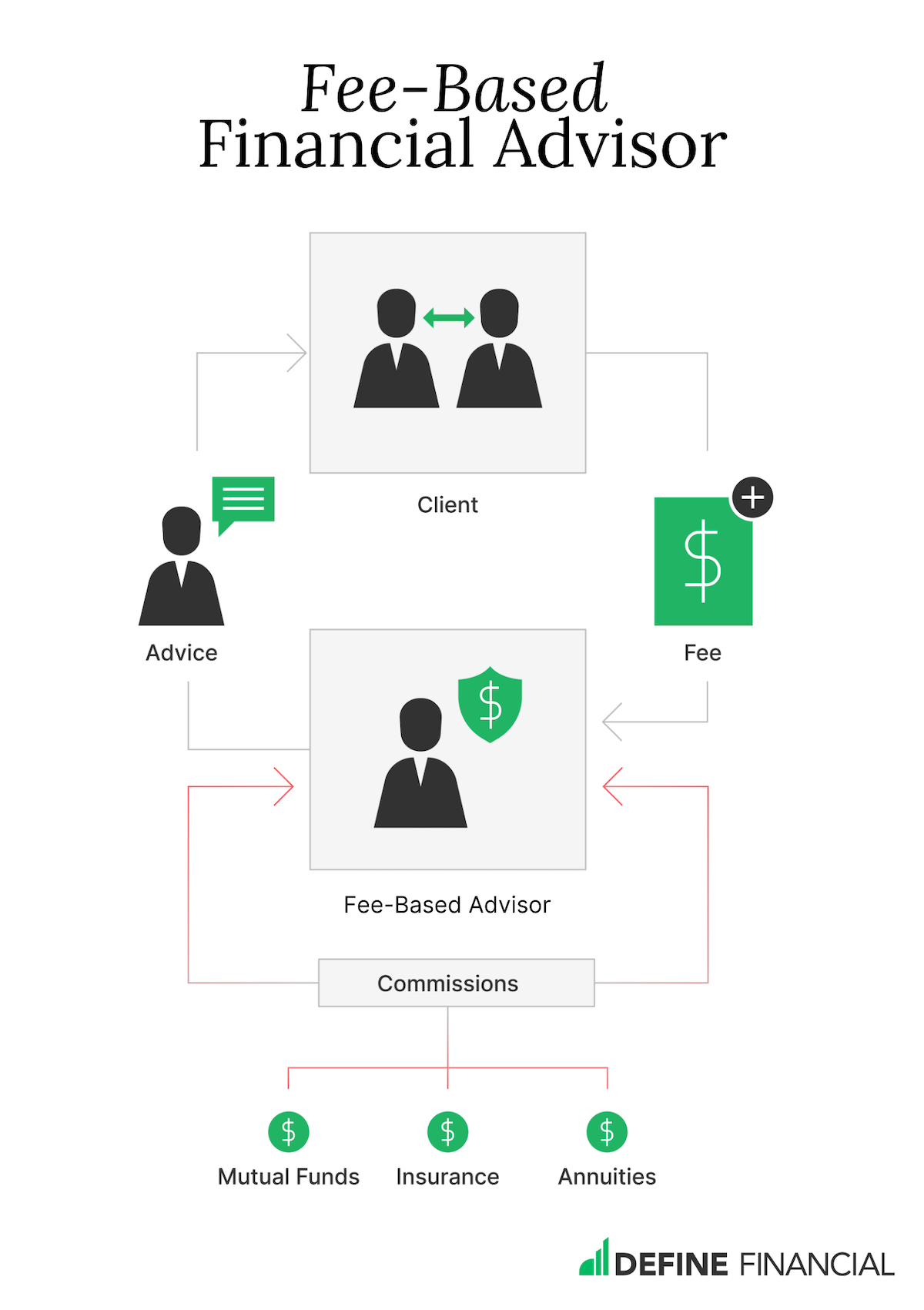

And that’s because most advisors are “dually registered” (a.k.a. fee-based).

A “dually registered” (or fee-based) advisor can take their fiduciary hat on and off. In other words, they are NOT a fiduciary 100% of the time.

One day, they are a fiduciary putting your interests first; the next, they sell you an insurance product with hidden fees and commissions.

When a financial advisor acts as a fiduciary 100% of the time, you don’t have to wonder how they are being compensated.

If you have any doubts, ask them to put their fiduciary status in writing. Here is a Sample Fiduciary Statement of Commitment that you can consider using.

2. What is Your Specialty (and Number of Clients)?

It’s critical to ask advisors what type of clients they specialize in working with. After all, you wouldn’t go to a personal injury attorney if you needed help with a divorce.

Here are examples of financial advisor specializations:

- Specific professions such as doctors, teachers, or Optometrists.

- Employees of a major company, like Broadcom or Microsoft.

- Certain age groups, like millennials or baby boomers.

It’s important that the professional you hire has the right expertise to help with your specific situation. It’s also comforting to know they’ve successfully helped other clients with similar needs and challenges.

Speaking of other clients, asking an advisor how many clients they serve is another good question for two reasons:

- It will help indicate how much time they have to spend with you.

- It highlights how personalized (and customized) their services are.

On average, an experienced lead financial advisor can serve about 100 clients. That number can increase or decrease depending on their service model, fee structure, and total team headcount.

3. What Is the Total Cost to Work With You?

Just because a financial advisor is a fiduciary 100% of the time does NOT mean it’s easy to understand the all-in costs.

Here are some of the common fees you might pay when working with a fiduciary:

- Advice Fees. These can be billed as hourly fees, one-time project fees, or a percentage of your investments.

- Transaction Fees. These are charged by the custodian (e.g., Fidelity, Schwab) when your advisor buys or sells investments on your behalf.

- Expense Ratio. A mutual fund or exchange-traded fund (ETF) charges this fee to cover operational expenses.

It’s important to note that a fiduciary financial advisor is ONLY compensated by the advice fee. And while they don’t benefit from other fees, they still have a legal responsibility to keep those costs low.

For example, let’s say your fiduciary advisor recommends that you put $100,000 in an S&P 500 fund.

Here are two S&P 500 mutual funds and their expense ratios:

- Rydex S&P 500 (RYSOX) = 1.60% or $1,680 per year

- Fidelity S&P 500 (FXAIX) = 0.015% or $15 per year

That’s a difference of $1,665 per year!

A fiduciary advisor is legally required to recommend the lower-cost option when two investments are identical (like the example above). This is why asking about all the fees you might incur is so important.

Review the advisor’s Form ADV and CRS for a detailed breakdown of their fees and services. These documents are publicly available, and every SEC-registered financial advisor must provide you with copies.

4. What Is Your Experience With Complex Financial Planning?

The number of years a financial advisor has been in business is not the only measure of their experience.

The most important factor is the type of experience they have in solving specific problems.

Some examples include:

- Reducing taxes in retirement (e.g., learning how to avoid IRMAA and Navigating the Medicare IRMAA tax brackets)

- Creating tax-efficient retirement income

- Increasing tax deductions through charitable giving (e.g., donor-advised funds)

- Lowering risk while maximizing investment returns

- Optimizing insurance policies in retirement

- Helping you transition into retirement (e.g., writing a retirement letter to your employer)

While you are asking them about their experience, you might also ask:

“Does your firm have a documented process for providing financial planning services and investment advice?”

This process should include how they gather your data, analyze your unique situation, and arrive at their recommendations. It should also include a methodology for implementing and monitoring this advice.

Lastly, one tip for gauging an advisor’s experience level is to ask about professional designations.

The most prominent designation is the Certified Financial Planner™ or CFP® certification.

A CFP® Professional must adhere to strict ethical standards, complete a series of rigorous coursework and exams, have at least three years of financial advisory experience, and have a four-year college degree.

In addition, a Certified Financial Planner must take continuing education classes each year to keep up with the ever-changing world of financial planning.

5. What Services Do You Provide?

Asking a financial advisor for a list of their services will help you understand if they:

- Have documented processes and procedures in place to care for their clients properly.

- Focus on one particular area of wealth management (e.g., investment management) or if they take a holistic approach.

Typical services include retirement planning, insurance, investment management, tax planning, and budgeting.

However, highly specialized advisors might offer more nuanced services such as stock option optimization, Roth conversion analysis, Social Security timing, and charitable giving.

An advisor’s list of services should be easy to provide. You might move on to the next candidate if the response is vague or confusing.

6. Where Do You (Safely) Hold My Money?

If there is one question to ask a financial advisor in 2025 that you do NOT want to miss, it’s this one.

Please confirm that your financial advisor uses a reputable third-party custodian to hold your investment/retirement accounts.

Well-known custodians include Fidelity, Schwab, Pershing, and TD Ameritrade.

When your advisor works with a trustworthy third-party custodian, they can’t go rogue with your money. They have limited authority to manage your investments and oversee your accounts.

(Hint hint: Bernie Madoff was NOT using a third-party custodian.)

A reputable third-party custodian also provides investors with FDIC and SIPC insurance. Every third-party custodian provides online access for you to see your accounts. Many also have physical branches across the U.S. for you to visit.

7. What Is Your Investment Philosophy?

While investments are just one aspect of financial planning, it is critical to ask a financial advisor about their investment philosophy before hiring them.

Do they invest in Exchange-Traded Funds (ETFs), mutual funds, or individual stocks as part of their investment strategy? What about investing in gold? How about hedge funds or alternative investments?

Here are some additional investment philosophy questions to ask:

- How do you incorporate investments in a workplace retirement plan like a 401(k)?

- How many positions do you include in each investment portfolio?

- Can you incorporate individual stock positions that I don’t want to sell?

- Do you have a process for tax-loss harvesting?

- How about tax gain harvesting?

In addition to getting answers to these questions, ask for a sample portfolio so you can examine it in detail and see things for yourself. While you’re at it, check those expense ratios!

Understanding the Role of a Financial Advisor

It’s crucial to understand what a financial advisor does and the scope of advice they can provide. This knowledge helps align your expectations and influences the questions you might ask during your search.

What Does a Financial Advisor Do?

A financial advisor is a professional who is paid to give financial advice to individuals and businesses. Their expertise typically includes guiding you through investment strategies, retirement planning, education funding, estate planning, tax issues, and insurance decisions.

Like a doctor, financial advisors diagnose your current situation and identify and implement strategies to help you reach your financial goals.

Key functions:

- Investment advice

- Retirement planning

- Tax-mitigation strategies

- Education funding

- Insurance and estate planning

Financial advisors can offer one, some, or all of the services noted above. Understanding their role and the services they provide will ensure you hire the right advisor and only pay for the services you need.

Types of Financial Advisors

There are various kinds of financial advisors, each differing in their services, compensation, and interactions with clients. More specifically, I would argue there are five different types of financial advisors:

- Full-Service Financial Advisors: Build and maintain your financial plan, manage your investments in accordance with the plan, and help with all of the different aspects of your financial life. Tax planning, insurance planning, cash flow management, coordination of retirement withdrawals, etc. If there is something they don’t do (or can’t do), they will typically offer to find the right third-party expert to help. In other words, they do all of the heavy lifting for you.

- Investment Managers: Strictly manage your investments for an ongoing fee. They don’t evaluate other aspects of your financial life or provide planning services. They buy and sell investments on your behalf based on the amount of risk you are willing to take. An Investment Manager could be a real-life person or a technology service (e.g., Robo-Advisor) managing your money via algorithms.

- Advice-Only Advisors: Do not manage your investments or implement any of the planning recommendations they make. Advice-only advisors answer your questions and tell you what you need to do in return for a fee; it’s your responsibility to take action and implement everything properly. This arrangement might be akin to a fitness expert creating a custom workout plan for you but not actually joining you at the gym to hold you accountable and ensure you implement the plan correctly, like a personal trainer.

- Insurance Agents: Help you solve a specific insurance need (e.g., Long Term Care Insurance) by educating you on different insurance options, shopping the market, and securing the best policy at the best price. Much like an Investment Manager, Insurance Agents will typically evaluate insurance needs in isolation and refrain from analyzing your entire financial life.

- A La Carte Advisors: Instead of giving advice, they typically take and process orders on behalf of their clients. If you want them to sell XYZ stock and buy ABC stock, they’ll process the trades for you in return for a commission. If you need a business loan, they’ll show you what they have available and help you apply. A la carte advisors are a good fit for people who want to maintain control over their investments and financial plan, but need assistance with execution from time to time.

» Learn more about the 5 Different Types of Financial Advisors

Understanding the type of financial advisor you’re engaging with is important for setting expectations and ensuring your financial needs and goals align with their service and fee structure.

Bottom Line (+ Free Resources)

Choosing a financial advisor is one of your most important decisions.

Working with the right advisor for your unique situation can be the difference between a carefree retirement and a stressful one.

Don’t be afraid to ask tough questions when meeting with an advisor. Like any other professional, they are there to serve the needs of their clients. A good advisor will welcome any and all questions you ask.

In addition to the suggested questions to ask a financial advisor in this article, here are a few of my favorite free resources to use:

- Questions to ask a CFP® Professional [Financial Planning Association]

- Investor Resources and Checklists [NAPFA]

- Financial Advisor Interview Questionnaire [Garrett Planning Network]

Please contact us if you have any questions or would like to evaluate and interview our firm.