Here’s a step-by-step guide on how to use Broadcom’s 401(k) plan and other employee benefits to save for your retirement.

As an employee for Broadcom, you can take advantage of several fantastic options for retirement savings.

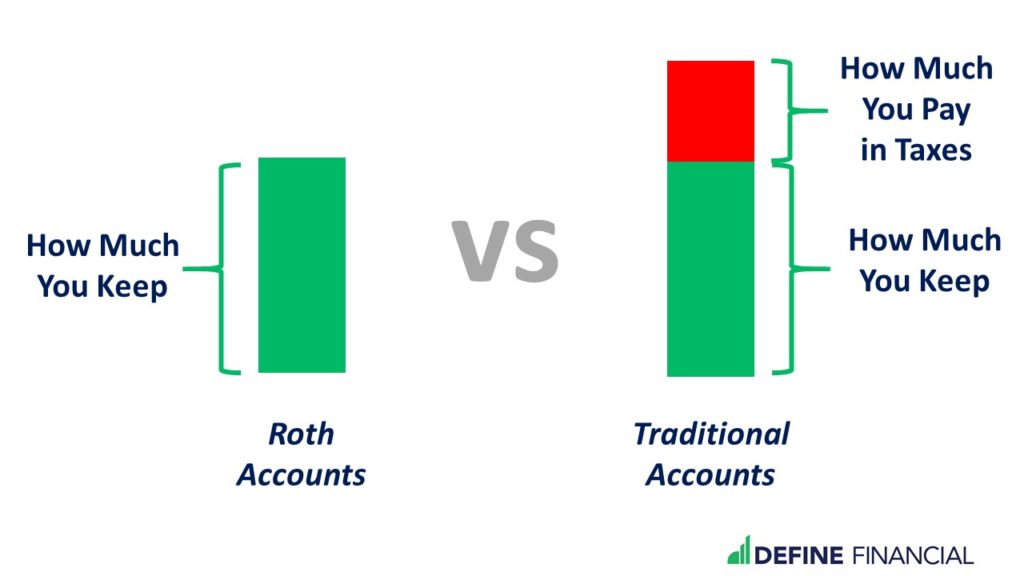

Broadcom’s 401(K): Traditional 401(k) vs Roth 401(k)

Broadcom recently made changes to their 401(k). You now have a few different options when it comes to saving for retirement: the Roth 401(k), the traditional 401(k), and new after-tax 401(k) contributions.

Broadcom’s Traditional 401(k)

The tax treatment on Broadcom’s traditional 401(k) is symmetrical – you get a tax break when you make a contribution, but get taxed when you make a distribution.

With Broadcom’s traditional 401(k), you receive a tax break for your contributions to the 401(k). This is referred to as a “pre-tax” contribution; you pay fewer taxes when you contribute to Broadcom’s traditional 401(k).

Here’s the catch: you pay taxes when you withdraw the money in the future.

When you put money into Broadcom’s 401(k), you won’t get a tax break. That’s the bad news. The good news is that you won’t pay any taxes when you make a qualified distribution.

Broadcom’s Roth 401(k)

Under Broadcom’s Roth 401(k) option, there are no tax breaks for your contributions. This is why it’s called a “post-tax” contribution; you are taxed upfront.

However, you will be able to withdraw the money tax-free in the future.

| Broadcom’s Roth 401(k) | Traditional 401(k) | |

| The Year(s) of Contribution | Contributions are taxed (no tax deduction received) | Contributions are not taxed (tax deduction offsets tax paid) |

| The Year(s) of Withdrawal | Withdrawals are tax-free | Withdrawals are taxed |

The natural question is deciding: “Do I want to pay taxes now (the Roth option) or pay taxes later (the Traditional option)?”

For us, it’s a very easy answer:

Go with the Roth!

Higher Savings with Broadcom’s Roth 401(k)

We’re big fans of the Roth option because putting money into Broadcom’s Roth 401(k) allows you to save more money.

How does that work? I’m glad you asked!

Here are three reasons:

#1: Tax Bracket Today < Tax Bracket in the Future

The general rule of thumb is that those early in their careers will make less income this year than in subsequent years.

Theoretically, one’s salary will increases over time, meaning savings and investments will increase, which then means investment income will increase. By the time you retire, theoretically, you will reap significant income from your investments.

Under the Roth option, you’d owe fewer taxes now since you’re most likely in a lower tax bracket.

In contrast, under the traditional option, you won’t owe taxes now in your currently low tax bracket. Instead, you’d be paying higher taxes in the future, when your high investment income puts you in a higher tax bracket.

#2: The Bottom Line of Savings

Often, people get so absorbed with taxes, they forget the basic point of retirement savings, which is to save more. Let’s look at this from a different angle: instead of taxes, let’s look at savings.

Let’s say you want to contribute $19,500 this year.

If you choose the Roth option, you’ll contribute $19,500 and you’ll pay the tax (let’s assume $4,290 or 22%) in the year’s tax filing. Your $19,500 sitting in the 401(k) earns income each year, and you can withdraw it in retirement, totally tax-free.

If you choose the Traditional option, you’ll contribute $19,500 and you’ll get a tax refund of (let’s assume) $4,290. Your $19,500 sitting in the 401(k) earns income each year, but when you withdraw it in retirement, you’ll pay taxes.

When most people receive the $4,290 tax refund from the government, what do you think they do with it?

Will they set that tax refund aside and invest it to cover future taxes in 40 years? Or, will they spend the $4,290?

Our guess is that most of the time, they will spend the $4,290 tax refund. And then, in 40 years, they will need to pay another $10,000 in taxes on the withdrawal. (This assumes some investment growth.)

This illustrates the psychology of savings: in each situation, you believe you’re saving the entire $19,500. But you have to look at the net savings, or your savings less your expenses:

- Under the Roth, your net savings is $19,500 – $4,290 = $15,210.

- Under the Traditional, your net savings is $19,500 – $4,290 – $10,000 = $5,210.

Utilizing a Roth 401(k) usually results in higher net savings because there is no temptation to spend the tax refund.

#3: Required Minimum Distributions (RMDs)

As you may know, every year the Internal Revenue Service (IRS) requires that a portion of money in certain tax-advantaged accounts must come out of those accounts.

This is called a Required Minimum Distribution, or RMD. Some of these accounts include:

- Traditional IRAs, SIMPLE IRAs, SEP IRAs

- Traditional 401(k)s, 403(b)s, 457(b)s

- Roth 401(k)s, 403(b)s, 457(b)s

If you’re thinking you can avoid the tax hit of a traditional 401(k) by simply leaving money in the account, think again. The U.S. government limits your long term tax-advantaged options.

How to Avoid RMDs on the Roth 401(k)

If you have a Traditional 401(k), there is no way to escape Required Minimum Distributions (RMDs).

With a Roth 401(k), there is a workaround to RMDs – allowing you to get tax-free growth until the day you die. It’s a two-step process:

- Contribute to Broadcom’s Roth 401(k).

- In retirement, roll that money into a Roth IRA. (This rollover does have some other considerations – such as investment options, fees, and creditor protection. It’s important to discuss with your financial advisor if a rollover is right for you.)

This strategy works because there are no RMDs on Roth IRAs.

How THE RMD AFFECTS YOUR SAVINGS

The RMD difference affects your savings in two ways:

- The RMD means you’re withdrawing money from your 401(k) account. When money comes out of your 401(k), it loses the special tax treatment. This means the money can’t grow as quickly.

- The RMD also means that the money is no longer in your 401(k) account, which means it’s subject to your spending/saving habits. Like the net savings example, the receipt of a large sum of money comes with the temptation to spend it.

Our suggestion is to avoid the RMD by using a Roth account. This way, you’ll only withdraw what you need in retirement.

The Tax Benefit of Broadcom’s Roth 401(k):

Let’s use an example to show the tax benefit of using Broadcom’s Roth 401(k).

In retirement, you find yourself in the 22% Federal tax bracket and 9.3% California tax bracket. You’ve decided to withdraw $100,000 to cover your living expenses for a year.

Again, with a Roth account, you pull out the $100,000 tax-free. It’s that simple.

In a Traditional account, you need to pay tax on the $100,000 distribution. You’ll need to take out additional money to pay the taxes on the $100,000 distribution. And, you’ll be taxed on the money you pull out to pay taxes. In short, if you need $100,000 of income, you could be looking at paying roughly $43,000 in taxes. Ouch!

Crazy tax bill aside, notice how you’ve also decreased your investment balance by $143,000 (a whopping $43,000 more than if you withdrew only $100,000 from your Roth account).

If you can’t decide between Broadcom’s Roth or traditional 401(k) account, think about that you get to keep more money when you make distributions from a Roth account.

If the prospect of paying a boatload in taxes each time you take money out of your 401(k) isn’t appealing to you, then Broadcom’s Roth 401(k) option has your name all over it!

Get the Employer Match on Broadcom’s 401(k)

Now that we’ve looked at the Roth 401(k) vs. Traditional 401(k), let’s move on to our next topic: free money!

Is free money something that interests you? Oh, really? You like free money, eh? Well, then you’ll love Broadcom’s 401(k).

Broadcom matches your contribution dollar-for-dollar on the first 6% of your salary.

We like numbers, so let’s put some numbers to this: You make $100,000 a year. You decide to contribute 6% – or $6,000 – of your salary into Broadcom’s 401(k). Because of the employer match, Broadcom will throw in another $6,000. Even though you only contributed $6,000 of your money, you end up with $12,000 in your retirement account at the end of the year.

That’s a pretty good deal, right?!

Don’t pass up the free money offered in Broadcom’s 401(k).

We’re big fans of 401(k) matches. Taking advantage of an employer’s retirement plan contribution is one of the first places you should put extra cash. Do not pass this up!

How Much Can You Contribute to Broadcom’s 401(k)?

Again, these amounts are either pre-tax Traditional 401(k) contributions or Roth 401(k) contributions.

We’ll discuss shortly how to save even more.

Recap #1: Maximize Your Retirement Savings Steps 1 – 3

Before we move on, let’s recap a bit because I know this has been a lot of information.

Step 1: Contribute 6% of your salary into a Traditional 401(k) or the Roth 401(k). Of course, we recommend the Roth 401(k).

Step 2: Watch your contribution double as Broadcom matches your money, dollar-for-dollar, in an Employer Match. Boom!

Step 3: Continue contributing to your 401(k) until you max out your contribution limit of $19,500 in 2020 (or $26,000 if you’re 50+). Again, this $19,500 maximum does not include the employer match. (We’ll discuss the maximum that does include the employer match below.)

If you’ve completed the above, you’ve done a great job so far! Maxing out your 401(k) contributions shows your commitment to your retirement savings.

There’s still a lot more opportunity on the table, so let’s keep going!

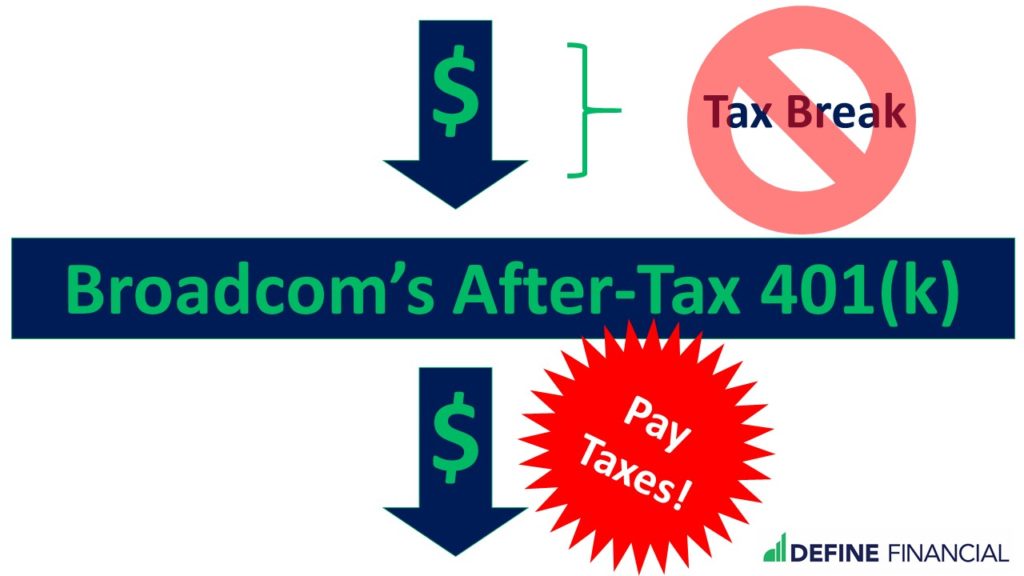

After-Tax Contributions & The Mega Backdoor Roth

One recent change to Broadcom’s 401(K) is that you now have the option of making after-tax contributions to your 401(k). Yep, these “after-tax” contributions are in addition to the $19,500 (or $26,000 if you’re 50+) that you’ve already contributed!

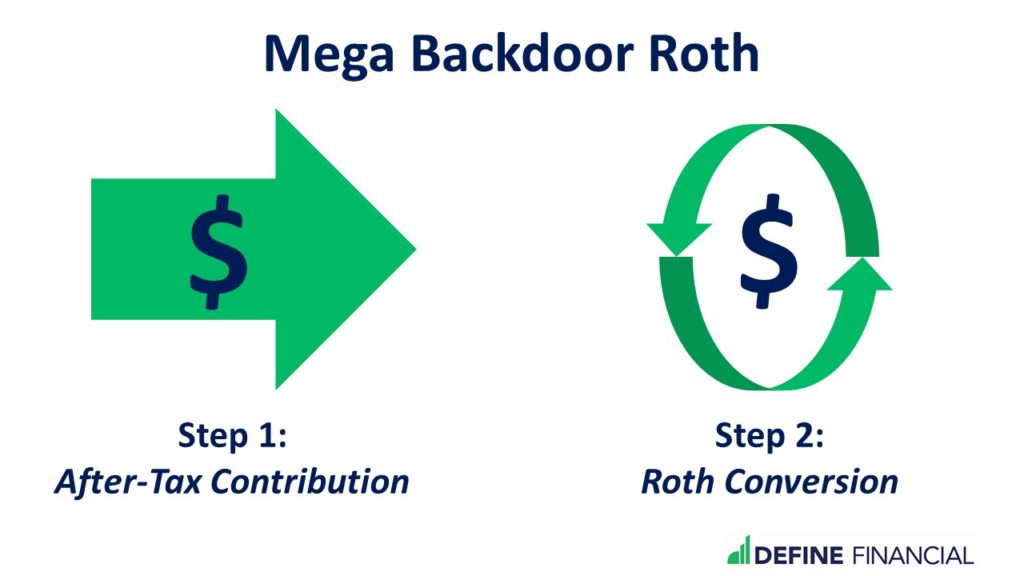

Another big change to Broadcom’s 401(K) is the ability to do “in-plan” Roth conversions, also known as a “Mega Backdoor Roth.”

We’re going to break both of these changes down. But, we’ve combined them into one section because doing one without the other is a huge missed opportunity, at least in terms of tax strategy.

Saving More with Broadcom’s 401(k): After-Tax Contributions

If you want to save more than the $19,500 (or $26,000 if you’re 50+) annual 401(k) contribution limit, the next best way to do is with the after-tax contribution.

Like other contributions made to Broadcom’s 401(k), after-tax contributions also grow-tax deferred.

That means you don’t pay any taxes while money grows inside your 401(k) at Broadcom. And like contributions to Broadcom’s Roth 401(k), you don’t get a tax break when you make an after-tax contribution.

The difference of after-tax contributions lies in the tax treatment upon withdrawal of your money. After-tax contributions have a tax basis. When contributions have a tax basis, it means you can withdraw only part of your money tax-free, which is determined on a pro-rata basis.

You don’t get a tax break for after-tax contributions to Broadcom’s 401(k), and you’ll pay taxes once you take money out.

What does that mean?! Before your eyes glaze over, I will spare you the details because you don’t need to know them!

This is where the Mega Backdoor Roth comes in: you can use the Mega Backdoor Roth to convert your after-tax contributions into tax-free Roth contributions. Doing this nullifies the problem of tax basis and makes qualified distributions tax-free. Yay!

Let’s continue on to discuss the Mega Backdoor Roth.

Tax-Free Retirement: The Mega Backdoor Roth on Broadcom’s 401(k)

Executing a Mega Backdoor Roth allows you to convert your after-tax contributions into Roth 401(k) contributions.

As we’ve learned, Roth 401(k) contributions are withdrawn in retirement tax-free.

Using Broadcom’s 401(k) to execute a Mega Backdoor Roth is a simple two-step process:

- Make after-tax contributions to Broadcom’s 401(k)

- Convert the after-tax contributions to Roth contributions

It’s a two-step process to take advantage of the Mega Backdoor Roth in Broadcom’s 401(k).

Easy, right?

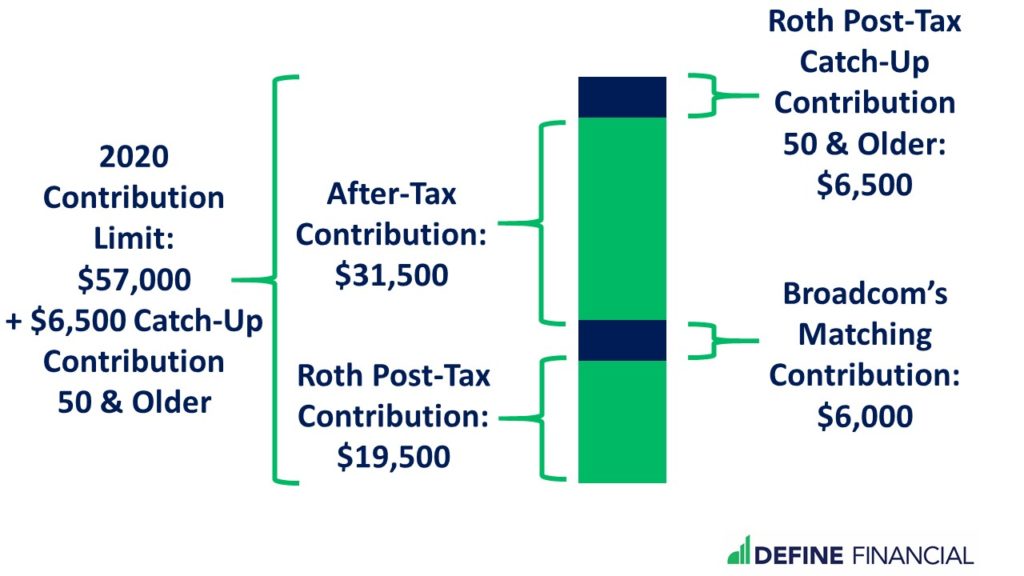

Total Contribution Limits for the 401(k)

For 2020, the total contribution limit is $57,000 for those under age 50. Those age 50+ can contribute an additional $6,500 for a total of $63,500.

This contribution limit includes:

- Personal contribution, the maximum of which is $19,500 (or $26,000 if you’re age 50+)

- Employer match, the total of which depends on your salary

- After-tax contributions, until you reach the $57,000 limit (or $63,500 if you’re age 50+)

With the option to contribute after-tax with Broadcom’s 401(k), you can put big money into your retirement savings each year.

Recap #2: Maximize Your Retirement Savings Steps 4 – 6

In our first recap, we left off at Step 3, where you personally contributed $19,500 to your 401(k) and Broadcom matched your contribution, up to 6% of your salary. Here’s our next recap:

Step 4: Figure out your after-tax contribution. Take the $57,000 limit (or $63,500 if you’re age 50+) and subtract your contribution (up to $19,500 or $26,000, depending on your age) and Broadcom’s contribution (through the employer match).

Step 5: Make your after-tax contributions to the 401(k).

Step 6: Convert your after-tax contributions into Roth contributions. It’s best to do this is as soon as possible to avoid tax basis issues on any investment growth.

If you have more money to save after all of that, be sure to read our post on contributing to Roth and non-deductible IRAs.

How to Choose Investments in Broadcom’s 401(k) plan

When it comes to investing, you may be familiar with the idea that successful stock market investing is boring.

What low-cost, buy-and-hold investing lacks in excitement, it makes up for in returns. Keep your investment strategy simple. Find your entertainment elsewhere.

Using a Target Date Fund in Broadcom’s 401(k)

What’s more boring than a target-date fund? And, why are target-date funds so boring?

With a target-date fund, you can pick a single mutual fund and never fiddle with your investments again. You’ll never have to rebalance or update your investment mix; you’ll never have to sell what’s up and buy what’s down. You’ll never have to do anything.

Broadcom’s 401(k) offers target-date funds. Here’s a little excitement: the Vanguard target-date funds offered in Broadcom’s 401(k) are some of the least expensive investing options available within Broadcom’s 401(k).

This means that even though the fund managers at Vanguard are working hard to keep your target-date fund on track for your retirement goals, you’ll be paying very little for those fund managers to do so. That’s great news because paying less in fees means having more money to keep for yourself.

Creating Your Own Investment Mix in Broadcom’s 401(k)

You’d be hard-pressed to create a better investment allocation than what’s in Vanguard target-date fund. That’s because the individual mutual fund offerings in Broadcom’s 401(k) are rather limited. Whatsmore, you’ll pay higher fees for the privilege. Most of the other funds offered in Broadcom’s 401(k) are more expensive than the simple, all-in-one, set-it-and-forget-it target-date fund.

BrokerageLink on Broadcom’s 401(k)

Yes, the investment options on Broadcom’s 401(k) are quite limited. So, what do you do if you want an elaborate investment mix in Broadcom’s 401(k)? Sign up for Fidelity’s BrokerageLink option.

By opening a brokerage account inside your plan, you’ll have access to thousands of investment options. You will also have access to Financial Advisors who specialize in managing Fidelity BrokerageLink accounts. (Spoiler alert: Define Financial is one of them!)

But, do you really need thousands of investment options? It depends.

If you’re working with a fee-only registered investment advisor managing your 401(k) on your behalf, it can make sense. If so, make sure to work with an advisor with a broad skill set in financial planning – as opposed to a single specialization in investment management. That’s because investing is just one piece of the financial planning puzzle.

You may not believe it, but we’ve come to the end of what you need to know about Broadcom’s 401(k) options. But fear not, we’ve got more information on some additional benefits of working at Broadcom – which includes their employee stock purchase plan (ESPP) and restricted stock units (RSUs).

Broadcom’s Employee Stock Purchase Plan (ESPP)

Why pay retail when you can get a discount? It’s the same for Broadcom’s stock! With Broadcom’s Employee Stock Purchase Plan (ESPP), you can purchase shares of your Broadcom’s stock at a discount.

Broadcom’s employee stock purchase plan allows you to buy Broadcom’s stock at a discount. Don’t pass up the discount!

What To Do With Broadcom’s Stock from their ESPP

Once you’ve purchased Broadcom’s stock at a discount, what do you do with it? Hold it forever? No! Sell it!

Financial planning 101 says:

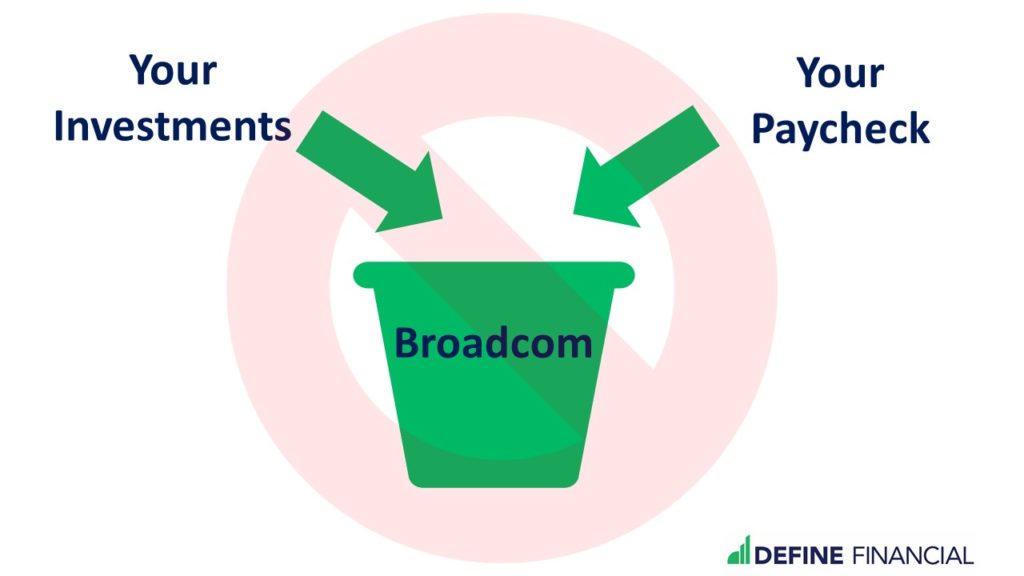

Don’t put all your eggs in one basket.

You put all your eggs in one basket when you buy (and keep) your employer’s stock. That’s because owning some of your employer’s stock means that both your paycheck and your wealth (your investments) are dependent on the same company.

Reduce your financial risk by selling all of your Broadcom stock immediately.

But, just because we love reducing risk, it doesn’t mean we should pass up a good deal. Any risk you take on you can reduce by selling Broadcom’s stock.

Our suggestion to consider (not individual advice): Take advantage of your Broadcom’s ESPP and buy Broadcom stock at a discount – and then immediately sell it for a profit!

Broadcom’s Restricted Stock Units (RSUs)

Restricted Stock Units (RSUs) are an incentive provided to keep you at the company. There is a vesting schedule that must be met before you’ll have full access to these. As soon as your restricted stock units are vested, sell them to reduce your risk. Then, invest that money for future growth.

Full Recap: How to Get the Most from Broadcom’s 401(k), RSUs & ESPP

Step 1: Contribute 6% of your salary into a Traditional 401(k) or the Roth 401(k). Of course, we recommend the Roth 401(k).

Step 2: Watch your contribution double as Broadcom matches your money, dollar-for-dollar, in an Employer Match. Boom!

Step 3: Continue contributing to your 401(k) until you max out your contribution limit of $19,500 (or $25,000 if you’re 50+). Again, this $19,500 maximum does not include the employer match.

Step 4: Figure out your after-tax contribution. Take the $57,000 limit (or $63,500 if you’re age 50+) and subtract your contribution (up to $19,500 or $26,000, depending on your age) and Broadcom’s contribution (through the employer match).

Step 5: Make your after-tax contributions to the 401(k).

Step 6: Convert your after-tax contributions into Roth contributions. It’s best to do this is as soon as possible to avoid tax basis issues on any investment growth.

Step 7: Choosing investments. Keep your retirement investing simple and boring. If you are managing your own investments, a low-cost target-date fund is hard to beat. If you crave more options, consider BrokerageLink and consulting with a fee-only financial advisor.

Step 8: Take advantage of Broadcom’s ESPP and RSUs. Broadcom offers some great stock perks. Take advantage of the discount and sell as soon as possible to reduce your risk.

We covered a lot of information in this article on Broadcom’s retirement options. Look over your current selections and make an action plan to optimize the benefits provided. If this is a little overwhelming to do on your own a fee-only financial advisor can help.

Other Ways to Save Money

If you’ve already accomplished all of the above, great job on taking advantage of the financial benefits of working at Broadcom!

Check out these additional ways to invest for retirement: