When it comes to the way you invest your hard-earned cash, you have a big choice to make. You can:

A.) earn the most money possible via a solid investing strategy, or

B.) enjoy and consistently rehash a neat little fairy tale about a mighty investing wizard doing magical and fanciful things with your money.

Unfortunately, you can’t have both. If you want to make the most money possible, you won’t be able to wow your friends and family with whatever inane investment strategy happens to be the latest trend that you’ve (mistakenly) sunk your retirement money into.

Alternatively, if you do want to have a sexy investing folktale to wow cocktail party guests, then it means you’re going to have to pay for it. And you’ll be paying for it by earning less money than the proven-but-boring investing strategy.

Most people fail to understand what investing is truly about – the numbers. At the end of the day, your investment return is determined by your investment return – and not the ghee-whiz investing strategy that gets you there. Said another way, the end is the only thing that matters in investing – and not the means to that end. The means doesn’t matter. The end does.

If you stay focused on the numbers as you invest your hard-earned cash, you’ll learn that interesting stories get in the way of those numbers. For veteran investors, they’ve learned to run screaming whenever an interesting-sounding investing strategy shows up on their doorstep, on CNBC, on Seeking Alpha, or anywhere else.

Now, I know that so far everything discussed has been pretty abstract. So, let’s talk about how some literal fairy tales can get in the way of your investment returns.

Key Takeaways

-

Boring, low-cost investments usually make you more money than trendy ones.

-

Flashy investments like dividend stocks, hedge funds, or startups sound cool but often underperform.

-

If you want to try risky ideas, use a small “fun” account and keep the rest of your money in proven strategies.

Should I Invest in Dividend Stocks?

We’ve already written a pretty extensive post about why focusing on dividend stocks is just plain silly. The article was so popular, in fact, that it made its way around the financial media circuit.

In short, there are a ton of problems with dividend investing. However, the cliff notes on dividend investing looks like this:

Dividend investing is not as lucrative as other investing strategies.

And, believe me, the numbers shows this!

But numbers are booooooooooring, aren’t they? At the end of the day, only stories can make dividend investing (as well as other silly investing strategies) interesting enough to make the news. Dividend investing tells a really great story! I mean, who wouldn’t want cash being spit out from their stock picks? Getting a paycheck from your stocks makes a compelling story! Retirees investing in dividend stocks can live off the cash that their dividend-paying stocks pay. It sounds simply fantastic!

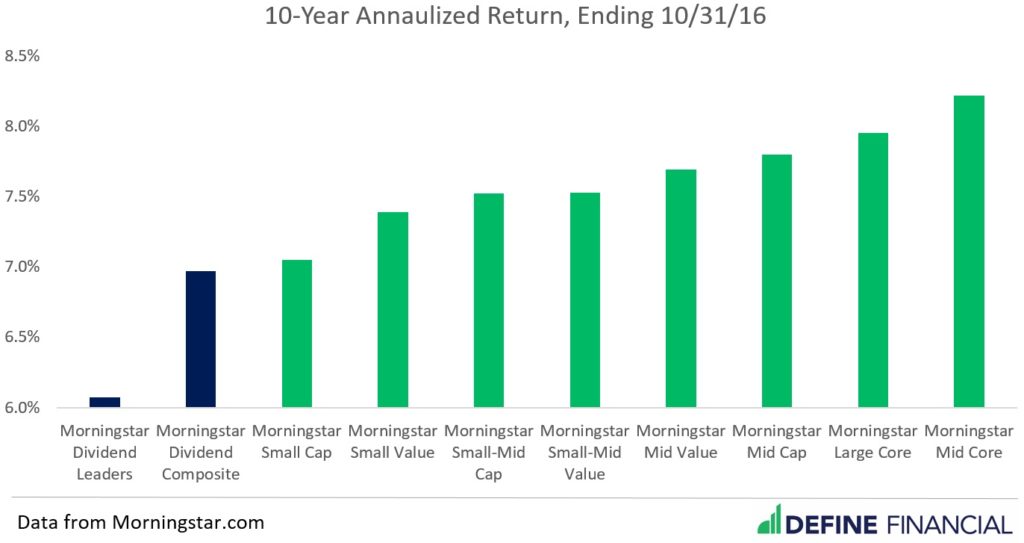

But, if you look at the numbers – and that’s what savvy investors do – you’ll know that dividend investing relative to other investment strategies just doesn’t make sense. The numbers just aren’t there. The end isn’t there, and the chart below shows it.

Dividend investing has not proven to be the most lucrative investing strategy.

As you can see above, dividend investing is silly if numbers are your game. But, if you want a wonderful fairy tale, then dividend investing – or one of the other sexy-sounding investing strategies – is for you. Savvy investors know that dividend investing is complete nonsense if your goal is earning the most money possible.

Should I Invest In Alternative Assets?

Now, let’s add another layer to the story of why nobody cares about boring-but-proven investing strategies but why people love fairy tales. Just like the silliness of dividend investing, anything in the alternative asset world is likely a crock.

If you’re not familiar with alternative assets, consider yourself lucky. Alternative assets are anything that aren’t conventional stocks and bonds. This can mean:

- hedge funds

- private equity

- fine art

- timber

- oil and gas pipelines

- illiquid real estate

The list goes on and on. These types of investments are extremely sexy-sounding! Who wouldn’t want to tell their friends and family that they are invested in a hedge fund? Who wouldn’t want to tell their friends and family that they have access to extra special investment managers who are able to invest in assets that aren’t publicly-traded? Obviously, all of this mumbo-jumbo makes for great cocktail party conversation!

But, if you look at the numbers, you’ll see that these types of investments greatly underperform plain-vanilla stocks and bonds. There are an overwhelming number of case studies that show just this. While there will be exceptions to the rule, you are much, much better off with a boring strategy by sticking with low-cost investments.

Should I Invest in The Latest Tech Startup?

Maybe you’ve been offered the chance to invest in a company that promises to cure brain cancer. Maybe you’ve been given the chance to invest in a company that will put electric vehicle charging stations on every street corner. These companies offer the chance to change the world – and your finances forever if you invest in them! How neat and amazing do these companies sound? They do sound amazing – but they are terrible investment opportunities.

Popular (read: overpriced) small companies are notorious for underperforming any number of other types of investments. It’s for the simple reason that they sound cool – and people hear about them – and then proceed to pile their money into them. Typically, the average investor is too late by the time they hear about the next fascinating tech startup. However, it very likely was not a very profitable venture anyway.

What’s Most Important to You: A Fairy Tale or Money?

At the end of the day, investing should be about your investment returns and not the stories that you get to hear from the salesmen. It should also never be about the stories you get to share with your friends and family to impress them.

That’s why, when it comes to investing, you have a decision to make. What’s more important to you? Do you prefer hearing and repeating a neat story about a magical investing wizard? Or, do you want to make the most money you can? You have to decide because you can’t have both.

I’ve been using the term fairy tale to describe any investing strategy that isn’t focused on low-cost investments because both fairy tales and sexy-sounding investing strategies that claim to outperform low-cost investing have one thing in common – they’re fiction.

Cowboy Account

At Define Financial, we understand that stories can be very compelling. After all, the ability to tell and understand stories is what us makes human. When it comes to being enamored by stories, our clients are no exception. So, when our clients come to us to ask about a neat fairy tale they hard Cramer tell on Mad Money, our solution is to open a “cowboy account.”

A cowboy account is a play account where clients take a little bit of their investable assets (no more than 5%) to invest in whatever interesting fairy tale they most recently heard about. Some recent examples of fairy tales that our clients have brought to us include:

- Amazon stock

- Blink initial public offering (IPO)

- Non-traded REITs, including the 10% sales commission

- Crypto-currency, like Bitcoin or Ripple

- Marijuana stocks

Giving clients a cowboy account allows them to scratch that fairy tale itch. Moreover, clients can scratch that itch without putting their entire nest egg at risk. This is why we think the cowboy account is a great solution for human beings so enamored by stories (read: all human beings).

Fairy Tales Don’t Make for Good Investment Returns

So, the next time you hear an interesting story about an investing opportunity, remember

You can have a compelling investing story to tell your friends, or you can have superior investment returns. At the end of the day, you can’t have both.

Taylor Schulte, CFP® is the founder & CEO of Define Financial, a fee-only wealth management firm in San Diego, CA specializing in retirement planning for people over age 50. Schulte is a regular contributor to Kiplinger and his commentary is regularly featured in publications such as The Wall Street Journal, CNBC, Forbes, Bloomberg, and the San Diego Business Journal.