Recently, we were working with a client entering retirement.

We were helping with her long-term financial plan and she had big (read: expensive) plans.

For her golden years, she dreamed of a six-figure remodel on her current home — or maybe even purchasing another, larger property.

The good news is that she can afford it.

The bad news is that the money she was planning to spend on housing was sitting in her investment portfolio (i.e. stocks and bonds) — invested alongside her retirement funds.

Investing is a Long-Term Game

You may have heard the saying:

“Investing is a long-term game.”

This saying is absolutely true! Investing is a long-term game — as in, you should expect to invest over decades, instead of years.

As with any other game, there are winners and losers. This begs the question:

What separates the winners from the losers in this investing game?

The winners follow a few simple rules, including:

- Keeping costs down

- Diversifying to reduce risk

- Staying committed to your investment plan

- Investing for the long-term

Stocks for the Long Run

You don’t need me to tell you that investors set aside money today to fund future goals.

People stash away money in a 401(k) (or similar retirement account) with each paycheck to be able to retire comfortably in the future.

When the future you’re saving for is very far away (i.e., 10+ years), then it may make sense to invest in stocks. Far-away goals that can be funded with long-term investments include:

Cash for the Short-Term

Just like it’s smart to set aside money for long-term goals, it’s also crucial to set money aside for short-term goals. Common short-term goals include:

- Creating a down payment for a new home or rental property

- Paying next year’s college tuition bills

- Getting a new (or used) car

- Funding a few years of a sabbatical, or entrepreneurial venture

- Paying unexpected medical bills

- Saving up living expenses in case if you lose your job or take a pay cut

Since there are so many reasons you might need cash, it makes sense to keep some money uninvested.

This can mean letting cash linger in a high-interest savings account.

It can also mean stuffing some cash in a money market account or buying CDs.

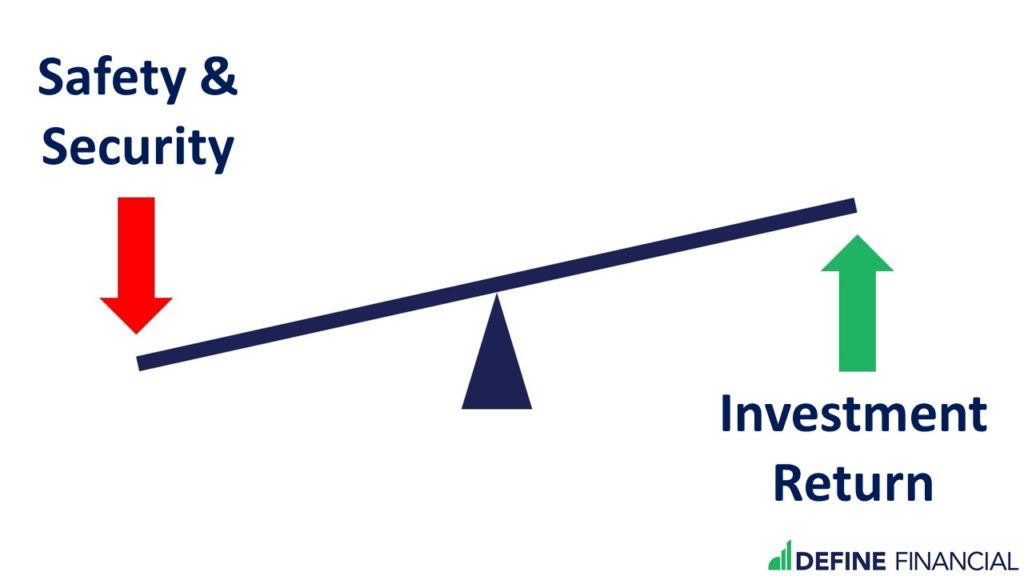

Unfortunately, parking your money in a savings account means earning a low rate of return. This can be frustrating. You watch your money grow at a snail’s pace when you might get better returns in the stock market.

However, a low return is the price we must pay. It’s a necessary evil for safety and security. By accepting a lower rate of return, you’re able to keep your options open. You have options because your money (i.e., your cash) is there when you need it.

Don’t Invest Your Home’s Down Payment

This leads me to the point of this post: Never invest your home’s down payment.

“But Jon, real estate is so expensive in California! I need this money to grow if I’m ever going to be able to afford a home!”

I feel your pain! Real estate prices in California are insane. But you can’t let the problem of perverted real estate prices create a whole new problem: losing your down payment in a turbulent stock market. This is because investment returns are never guaranteed. Any money earned in the stock market can be lost just as easily as it’s gained.

The client I referenced at the beginning of this post was making a common mistake. Instead of holding cash, she had her house money invested in the stock market. This left her vulnerable to losing huge if the market tanked at the wrong time.

I Kept My Home’s Down Payment as Cash

Case in point: While I could rent, becoming a homeowner was part of my family’s financial plan. Once we made the decision to become homeowners, we moved a chunk of our investments to cash. We plopped that cash into a high-yield savings account. Our money sat there for a few years as we moved toward homeownership.

I didn’t enjoy the fact that I might miss out on higher investments returns elsewhere. But, I knew this step was crucial. After all, we didn’t want to lose the down payment on our home in the next stock market crash, did we?

After we had been saving for a few years, my wife and I found the perfect home and made an offer. Crazily enough, the Emerging Market sell-off began right around that time. No one remembers the Emerging Markets sell-off now, but anyone investing at the time lost a piece of their nest egg — at least for a little while.

Fortunately, the stock sell-off was a non-issue for us. Although we did see a temporary loss in our retirement portfolio, all the money we had set aside for our home down payment was safe and secure in a high-interest savings account. We didn’t earn much on our down payment funds while they were tucked away in savings, but our money was there when we were ready to buy our home.

Invest in Stocks and Bonds for the Long-Term, Choose Cash for the Short-Term

When you have decades to invest your money for a long-term goal like retirement, the little bumps in the road (i.e., the Emerging Market sell-offs, etc.) don’t matter as much. You may see losses this month and gains several months down the line. That’s because with long-term goals, you’re focused on long-term returns.

The bottom line: You don’t want to invest the down payment for a home in the stock market, just like you wouldn’t want to invest money you need to pay college tuition later this year. That’s because buying a home is likely a relatively short-term goal — not a long-term goal like retirement.