If you’re thinking of using long-short mutual funds as part of your investment strategy, you may want to think again.

Despite what you may have read in an investing magazine, this investment plan isn’t for the faint of heart.

Long-short mutual funds are a lot more work than many people realize. And you have a smaller chance at the amazing growth you’re expecting.

Why? Let’s dive in!

Key Takeaways

-

Long-short mutual funds are expensive and complex — they typically charge high fees and require expert-level skill to manage effectively.

-

Shorting stocks comes with unlimited risk — you can only gain so much, but losses can be infinite if the stock rises.

-

Most investors are better off with a simple, diversified, low-cost strategy that doesn’t rely on market timing or manager skill.

Regular Investors vs. Long-Short Money Managers

A long-short mutual fund is one that uses both long and short selling strategies. Money managers have to pick stocks that they think will go up, and have to predict which stocks are going down.

Most money managers who successfully use a long-short strategy are exceptionally skilled. In other words, they’ve had years of experience in the markets, and know exactly what they’re doing.

The regular investor, on the other hand, has a much smaller chance at the growth they’re looking for. As a result, most investors would be better off using a conventional, low-cost investing strategy such as a broad market index fund.

But, why? Here are three of the biggest reasons long-short mutual funds aren’t right for everyone.

Reason #1: Long-Short Mutual Funds are Expensive

Using an actively-managed fund is rarely cheap. This means you pay a lot of money to a manager who may (or may not) beat the performance of a typical low-cost index fund. And no matter what anyone says, it’s extremely unlikely your money manager will outperform an index fund just because he or she says they can.

Remember, keeping your costs low means keeping your money for yourself. The fewer fees you pay, the faster your money will grow.

Reason #2: They Can Have Limited Upsides with Infinite Downsides

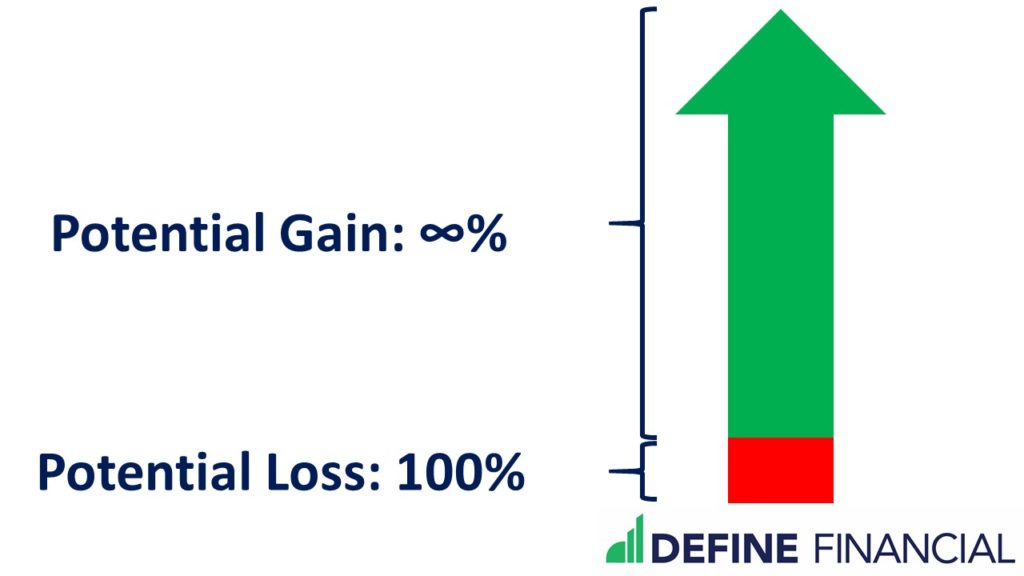

When you invest in stocks, there are two directions the value of your stock can move: up or down. Still, it’s the degree of this movement that matters.

When investing in stocks, you have literally unlimited potential for your investment return to increase forever, indefinitely. In short, you are looking at a return potential of infinity.

That sounds pretty good, right? Who wouldn’t want an investment return with the potential to be infinity? On the flip side, however, you could also lose your entire investment. Here’s an example of how either situation could work out:

Bob invests $100 in the stock of COMPANY A. COMPANY A goes bankrupt. Bob loses $100.

Charlie invests $100 in the stock of COMPANY B. COMPANY B invents a new widget. This sends the price of the stock soaring. Charlie’s investment return is literally infinity.

When you invest in a stock, this is usually a risk worth taking. You could lose $100, but your investment return can be infinite.

When you invest, you have infinite return potential but can only lose the amount of your original investment.

Investing in stocks traditionally is known as going “long” on a stock. This is the “long” portion of the long-short mutual fund.

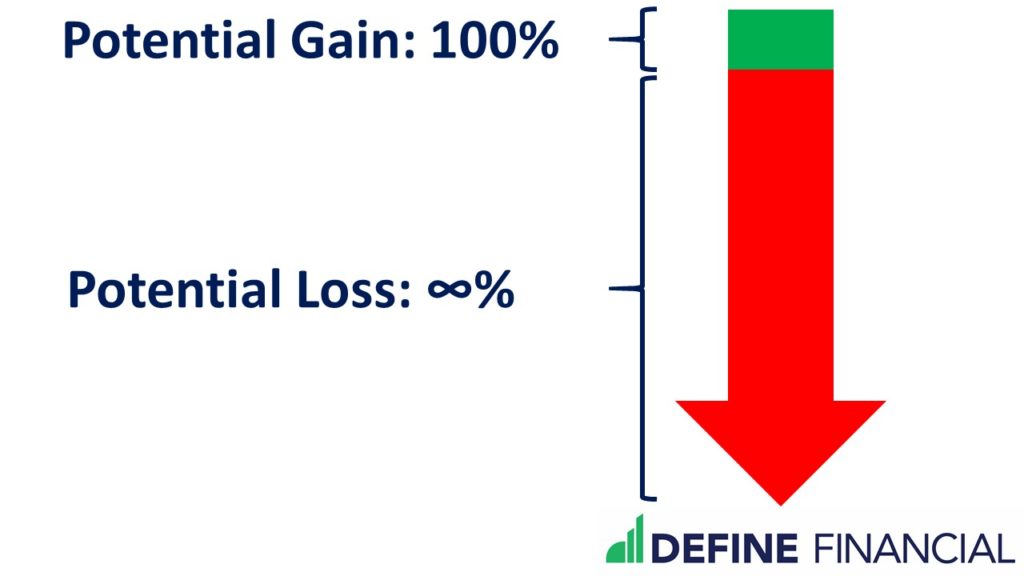

When you short a stock, you now have limited upside potential and infinite downside. That’s not a very attractive investment. Let’s use an example:

Larry shorts the stock of COMPANY A. Since COMPANY A goes bankrupt, Larry gets $100.

Mark shorts the stock of COMPANY B. Since COMPANY B invents a new widget, sending the price of the stock soaring, Mark faces infinite capital calls. This means that Mark must keep putting more money into his investment account – just to see that money disappear as the price of COMPANY B stock continues to rise.

When you short a stock, you have unlimited loss potential but can only double the amount of your original investment.

In summary, when you go long on a stock (the conventional way to invest), you have infinite return potential and only risk the amount of your original investment (i.e. $100). When you short a stock, you have limited upside (the current price of a stock), but an infinite potential for loss.

Unless you’re always winning, this is not a good deal.

Reason #3: Long-Short Mutual Funds Need Active Management

If you’ve come across a successful actively-managed mutual fund, it’s crucial not to act right away. Why? Because chances are good that, fairly soon, this fund will turn into a big, fat loser.

Why does this happen? Too much money.

Mutual fund money managers are able to choose the best investments when they have limited money to invest.

Investing superstar Warren Buffett is someone who faces the “too much money” conundrum. You see, there are only so many good investment opportunities available.

So, what happens when an investment manager has more money to invest than there are good things to invest in? Does the manager just sit on the cash waiting for the next great thing to come along?

Unfortunately not. Mutual fund managers must invest the cash they have. And if they have more cash than good things to invest in, those managers are forced to invest in not-so-great investments.

Let’s use an example to illustrate this point:

Michael the Mutual Fund manager is given $100,000 to invest. He finds a great investment opportunity with COMPANY X stock and invests the $100,000. The stock price of COMPANY X goes soaring and Michael the Mutual Fund manager looks like a genius.

Because of his success, Michael is featured in several financial media publications. Investors start clamoring to invest in Michael’s mutual fund. He now has an additional $100,000,000 to invest!

Unfortunately for the new investors, there simply aren’t any good investment opportunities available. But, Michael the Mutual Fund Manager must invest the $100,000,000 he was given. He’s not allowed to simply sit on that much cash. So, he invests in COMPANY Y and COMPANY Z, knowing that neither are great investments. But, Michael has no choice. He must invest the money he has.

The results are predictable. Michael’s Mutual Fund now shows poor performance. The new investors in Michael’s Mutual Fund are disappointed. And, guess what? Those new investors would have been better off with a low-cost index fund.

So, what are the odds that any random money manager can outperform an easily accessible, low-cost index fund? About 17%. Said another way, you’re facing an 83% chance the low-cost, diversified index fund will outperform active strategies – active strategies such as a long-short fund.

Conclusion: Save Your Sanity

To wrap it all up, long-short mutual funds are not appropriate investments for the bulk of investors. Why? Because, a) long-short mutual funds are expensive, b) the nature of shorting a stock means getting limited upside but infinite downside, and c) active manager performance can wane over time as assets under management increase.

Like it or not, one of the best investment choices you can make is to take yourself out of the equation. Invest your money in low-cost, easily accessible funds that are easy to manage and understand. Quit chasing the huge wins, and save money in the process.

Your portfolio – and your sanity – will thank you.

Taylor Schulte, CFP® is the founder & CEO of Define Financial, a fee-only wealth management firm in San Diego, CA specializing in retirement planning for people over age 50. Schulte is a regular contributor to Kiplinger and his commentary is regularly featured in publications such as The Wall Street Journal, CNBC, Forbes, Bloomberg, and the San Diego Business Journal.