Throughout your career, you’ve diligently socked away money so you are able to enjoy your dream retirement.

Now that you are getting closer and cementing your exit strategy you may be wondering, “How much money can I take from my investment portfolio?”

This is a question we get asked all the time. It’s natural to want to know the amount you’ll have to live on year to year.

But, it isn’t all about how much you can take from your investment portfolio.

There are other factors besides a strict percent withdrawal rate that can optimize your investments and help create even more wealth.

Sustainable Portfolio Withdrawal Rates: The Percent Rule

Any money nerd knows Bengen’s 4% rule of thumb. It’s a simple idea: you can withdraw 4% from your investment portfolio throughout retirement. This amount adjusts annually for inflation.

So, if you’re sitting on $1,000,000, Bengen’s paper suggests that you can withdraw $40,000 in your first year. And the year after that, you can withdraw $40,800 – assuming that inflation was 2% the prior year. In your third year of retirement, you’ll withdraw $41,616, assuming that same 2% inflation. If you follow that schedule, you shouldn’t run out of money – or so the legend goes.

Bengen’s 4% rule of thumb suggests that one can withdraw 4% from their investment portfolio annually (adjusted for inflation) and have enough money through retirement.

Of course, newer research suggests that 4% should be slimmed down to 3% — ignoring any fees (like expense ratios) that come with investing.

How Much Money Can I Withdraw from My Investment Portfolio?

Relying on a simple percent withdrawal rate, whether it’s three, four, or any other percentage, is a little too simplistic. It may feel good to have a specific number but it’s missing the mark a bit.

Perhaps the best way to illustrate this is with a silly story.

Alexander wants to sell his home in Babylon. He enlists the help of the local real estate agent, Bucephalus. Alexander asks Bucephalus, “How much can I sell my home for?”

Bucephalus knows this isn’t the right question to ask. That’s because there are many elements involved in selling a property. Something to consider is that the house may fetch a higher price if some improvements are made.

If Alexander sells the house “as is”, he may be able to get $500,000. However, if he puts in upgraded air conditioning and staging at a cost of $11,000, he could likely sell the home for $550,000.

It doesn’t really matter what the sale price of the house is, what matters is the actual cash you’ll get in the end.

So, Alexander should be asking:

What can I do to walk away with the biggest pile of money after selling my house?

Let’s bring this back to how much money you can squeeze out of your investment portfolio. You may be missing some important questions:

- What can you do to increase your quality of life in retirement?

- What can you do to have more money in retirement?

Coordinate Social Security with Investment Portfolio Withdrawals

One strategy you may be overlooking when you ask How much money can I take out of my portfolio? is delaying claiming Social Security retirement benefits.

Waiting to claim Social Security is often overlooked and can offer many benefits – if it’s right for you.

How Social Security Retirement Benefits Work

The longer you wait to receive Social Security benefits, the more money you get from the government. For this reason, we usually advise clients to delay Social Security.

Take advantage of the rules of Social Security to increase the amount of money you can have in retirement.

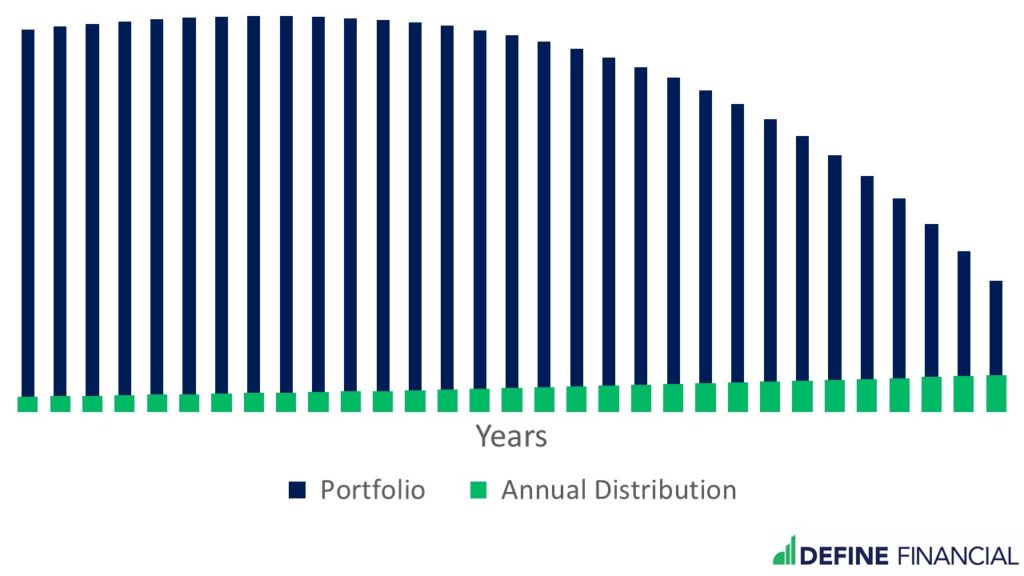

However, when delaying Social Security, you’ll need to make up for the income elsewhere. After retirement – but before Social Security – you may need to draw down from your investment portfolio. Of course, once Social Security benefits begin, you’ll be able to reduce the amount you’re withdrawing from investments.

The amount of money that you take from your investment portfolio over time will fluctuate. Unlike Bengen’s 4% rule, you won’t be using a constant withdrawal rate.

Consider not just your investments – but your other assets – to increase your quality of life in retirement.

When you factor Social Security into the equation, the answer to How much money can I take out of my portfolio? will continuously change. It isn’t going to be, $5,000 or $1,000 a month for life. It’s going to be:

We’re going to delay Social Security. During that time, we’re going to distribute $5,000 a month from your portfolio. After you start receiving Social Security retirement benefits, we’ll decrease the amount we’re taking from your portfolio by $2,000 a month.

Why use this strategy? Because this will allow you to have more money over time. Matching your portfolio distributions to your Social Security income will give you a better chance of financial success.

Don’t Ask How Much Money Can I Take from My Investment Portfolio?

How much money you remove from your investments during retirement will fluctuate from year to year.

Timing distributions from your portfolio to line up with Social Security benefits is just one of many ways to maximize retirement income. There are additional impactful tools financial planning can do during your gap years, these include:

- Partial Roth conversions

- Accelerating – or delaying – business income before and after required minimum distributions (RMDs) from IRAs

- Timing portfolio distributions with pension and annuity payments

- Timing portfolio distributions with RMDs for IRA accounts

This global view of your finances will give you the greatest chance of financial success and continued wealth building in retirement.