At the risk of throwing salespeople everywhere under the bus, I’m going to share a few stories that might change the way you think about how these professionals are compensated.

Recently, I had a client tell me that they asked their life insurance agent for an increase in their disability insurance policy.

And it didn’t go all that well.

Why? Because the life insurance agent is a salesman.

How Sales Commissions Work

My client’s question about increasing their disability insurance policy generated this response:

It will be a lot of work for a small benefit.

This response can be baffling. Obviously, applying for more disability insurance wouldn’t be a lot of work. You wouldn’t have to do much besides signing a form and supplying a check.

And I’m not actually sure how much “work” would be required on the agent’s part, either.

What the agent really meant was: It was more work than he was willing to do for the commission he was getting in return.

Why Does it Matter?

By and large, salespeople are compensated when they make a sale. This is common knowledge and totally acceptable. Unfortunately, the way commissions are determined may not always help salespeople work in the consumer’s best interest.

Why? Because they make more money if you spend more.

Let’s say you’re in the market for a new set of wheels. Your commute is just a couple miles, so you’re thinking about buying a moped that’s cheap and easy to maintain. Beyond those benefits, a moped would be fun to drive and make parking a breeze. So, why not buy a moped, right?

You head to the local car dealership to peruse the mopeds for sale. You let the car salesman know you’re looking into a moped. His immediate response is to offer you a test drive in their newest sedan.

Why would the car salesman do that? Why does he try to sell you a sedan after you specifically explained that you’re in the market for a moped?

It all has to do with how the car salesmen gets paid. If he sells you a moped, he makes a small commission. But if he sells you a sedan, he makes more.

This is where your interests and the salesperson’s interests collide. While he or she might truly want to help you, they also want to make a lot of money.

Believe it or not, the salesman may even flat out refuse to sell you a moped because the commission isn’t worth his time and effort. In the time they spend filling out your paperwork for a new moped, they could be selling someone else a luxury SUV.

For the commissioned salesperson, selling a moped just isn’t worth his time.

Commissions Make for Bad Advice

Unfortunately, the way commissions work negatively affects nearly all business models. Whenever someone is working on commission, they have an incentive to get you to spend more.

This usually means they’ll push the most expensive item they have for sale.

Another caveat to consider: The items that pay the highest commissions are usually the most profitable. And, you know what that means; the more profit that makes it way up to the top, the less valuable the item is to you.

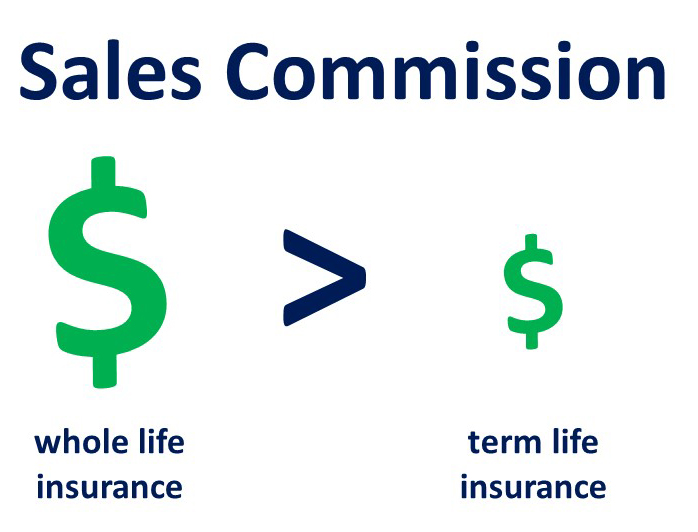

Whole life policies pay out huge commissions to the professionals who sell them, which lead to huge profits for the life insurance company. The consumer, on the other hand, overpays for a policy that they likely don’t need.

Term life insurance is cheap and pays out small commissions. You can buy it from an agent, but they won’t be too enthused. In fact, they’ll probably try to sell you whole life insurance even after you insist on buying an inexpensive term life policy.

Why You Should Work with a Fee-Only Advisor

Finally, we’ve made our way through the examples to the real point of this post. While you can buy nearly anything from a professional who makes a commission, it’s possible to avoid it in certain industries.

When you choose a financial advisor, it’s crucial to make sure you’re working with a fee-only advisor.

When you work with a financial advisor that works for commission, you may end up with investments and/or insurance that pay the highest commissions versus what is actually best for you. With a fee-only advisor, on the other hand, you’re paying for non-biased advice.

That non-biased advice may end in a suggestion that you buy something – maybe a low-cost life insurance policy, or inexpensive index fund. Or, that advice may be to buy nothing at all – to save your money in a rainy day fund.

With a fee-only advisor, their job is not to sell you something – it’s to give the best possible financial advice. Why? Because if the fee-only advisor gives you great advice, then you’ll want to come back for even more great advice. And naturally, you’ll tell your friends as well.

Conclusion

If my client’s insurance agent had her best interest in mind, he would have done whatever was necessary to bump up the insurance coverage.

But, as we all know by now, he doesn’t care about her financial well-being. As a salesperson who works on commission, he has the incentive to care more about his financial health than anyone else’s.

The bottom line: No matter what you’re buying – whether it’s a moped, life insurance, or a mutual fund – you should know how your salesperson is compensated.

If they get paid more when you spend more, you should take special care to research the best value for your situation first, then stick to your guns. Know that “advice” you get from a commissioned “advisor” is little more than a sales pitch.

In the case of choosing a financial advisor, you can avoid any awkward moments or bad advice by choosing a fee-only advisor who doesn’t work for commission. Not only will you get advice tailored to your unique situation, but you’ll know it’s not influenced by the almighty commission dollar.