Today I’m sharing where to put your money now (and in what order!).

Following this step-by-step guide can lead to massive tax savings over your lifetime.

It can also help protect you when the markets take a turn for the worst.

The problem is there are so many ways to invest and save. It’s overwhelming.

So if you want answers to questions like…

- Should I max out my HSA?

- How can I reduce my tax bill?

- Where to save money for retirement?

…today’s comprehensive guide is for you!

Where Should I Put My Money? A Simple Framework

To help you figure out the best place to put your money now, we’ve created the following step-by-step guide.

Please recognize that not every savings or investment option discussed may be right for you.

You may already have a rainy-day fund (Step #1).

Or, you may not be able to make after-tax contributions to your workplace retirement plan (Step #8).

If an option doesn’t pertain to you, just move onto the next step!

#1: Prioritize a Rainy-Day Fund: The First Place to Put Spare Cash

Already have a rainy-day fund? Then skip to the next step: paying off debt.

Creating a rainy-day fund, before funding any investment accounts, is step number one for every retirement saver. You never know when you might need easily accessible money.

Consider a worst-case scenario: Your car or your home need an expensive repair.

Or, on the upside: You want to invest in a new opportunity, and you need seed money!

“Where are you going to pull the money from?”

What if all your money is locked up in a retirement account – like your 401(k)? There are tax penalties for removing money early.

If you choose to borrow on credit, like using a credit card or a home equity line of credit, you’ll have to pay interest.

There’s a benefit to having cash that’s accessible without penalties or fees.

How Much Cash to Stash

How much cash should you stash? The CERTIFIED FINANCIAL PLANNER Board of Standards suggests you save up to six months of mandatory living expenses. This means you should save enough cash to pay six months of rent (or mortgage payments), car insurance, groceries, and more.

Hint: You’ll want to save for 6 months worth of bare necessities. You don’t have to save cash for dining out, gifts for family and friends, or any other luxuries. Only save for the necessities. If you want to keep more than six months of living expenses in cash, that’s fine too.

Where Should You Keep Your Rainy-Day Fund?

Don’t settle for stashing your cash just anywhere. Make your money work for you!

Your local bank or credit union usually won’t give you much of a return for storing your money. Instead, consider an online, high-yield savings account. NerdWallet has a list of online savings accounts offering the highest interest rates.

#2: Pay Off Debt with Extra Cash

No debt? That’s great! Skip to the next step!

Your second priority is to pay off debt. Why pay off debt as your next priority? Paying off debt is a guaranteed investment return.

When you pay off debt, you get a guaranteed investment return equal to the interest rate of your debt!

A guaranteed investment return means that when you put cash towards debt, your return is equal to the interest rate on that debt.

Let’s use an example:

You’re carrying a credit card balance with an interest rate of 15%.

When you use cash to pay down that debt, you’re instantly earning a 15% investment return.

And let me assure you, earning a 15% investment return is a very big deal. In fact, you probably won’t be able to earn a 15% investment return anywhere else. (And if someone does approach you with a guarantee to earn 15% investment returns, please run screaming from them.)

Paying Off Debt is a Really Good Deal

You don’t have to fully understand the concept of paying off debt to take advantage of its benefits. Just know that any money put toward decreasing or eliminating debt is a smart plan. The higher the interest rate on the debt, the more you save when you decrease your debt.

You get a big investment return when you pay down debt with a high interest rate.

Strategies to Pay Down Debt

If you have more than one source of debt, how do you decide which loan to pay off first? Should you pay down your physician mortgage loan, auto loan, or credit cards?

Mathematically, it makes the most sense to pay off debt with the highest interest rate first. If you have a balance on your credit card and home equity line, throw cash at the credit card first. That’s because your credit card likely charges a higher interest rate than the home equity line of credit.

Extinguish debt quickly by paying off debt with the highest interest rate first.

Another strategy for paying off debt is to focus on the smallest balance first. This strategy, popularized by Dave Ramsey, is based on human emotion – and not math.

The theory is that we score an emotional high when we close out a loan, regardless of the size or interest rate.

Starting small allows you to get a quick win, It’s that ‘check the box’ satisfaction. Getting this psychological reward encourages us to keep paying off debts until they all disappear.

Paying off low-balance loan account balances first can score you an emotional high that will encourage you to keep paying off your debts.

#3: Employer Match on Workplace Retirement Accounts

If you don’t get an employer match for contributions to your workplace retirement account, skip to the next step, funding a Health Savings Account (HSA).

May I interest you in some free money? If so, listen up! Many employers offer employees a “match” on money put into their workplace retirement account. Your workplace retirement account may be a 401(k), 403(b), 457(b) or SIMPLE IRA.

Employers may offer a dollar-for-dollar match, although sometimes less. Consider an example:

Your employer offers a dollar-for-dollar (100%) match. This match is good for up to 5% of your salary. If you’re earning $100,000, and you put $5,000 into the company 401(k), your employer will put in an extra $5,000 on your behalf. That’s real money!

Don’t leave free money on the table. Take advantage of the employer match!

Not all employers are this generous; matches vary by employer.

Whatever the match, make sure to put enough money into your workplace retirement plan to earn the full employer match. Whether it’s free money in your 401(k), 403(b), 457(b), or SIMPLE IRA, jump on it! Anyone who knows anything about money agrees: do not pass up free money!

Use the Roth Option

If you are able to contribute to a Roth 401(k), Roth 403(b), or Roth 457(b), strongly consider it over a traditional option.

#4: Should I Max Out My HSA? (Hint: Yes!)

I love the Health Savings Account. I like to call it the “magical unicorn of tax-advantaged investment accounts.” (Only a real money nerd would describe it as such.)

Why so much love for the HSA? HSA’s have not one, not two, but three tax advantages. Yes, Health Savings Accounts are triple tax-advantaged. No other account offers a benefit this amazing.

Don’t miss out on these wonderful tax advantages:

- Tax deduction when you put money into an HSA

- Tax-deferred growth while your investments are in the HSA

- Tax-free distributions when you take money out for qualified medical expenses

To qualify for an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). If you’re already enrolled in a HDHP, we recommend maxing out your contributions to an HSA.

If you’re not enrolled in a HDHP, consider switching over so you can max out your HSA and save on taxes.

Keep in mind HDHPs are a very particular type of health coverage and are not right for everyone.

#5: Employee Stock Purchase Plan (ESPP)

No access to an Employee Stock Purchase Plan (ESPP)? Skip to the next step of maxing out your workplace retirement plan.

Why pay retail when you can get a discount? It’s the same for employer stock! With an Employee Stock Purchase Plan (ESPP), you can purchase shares of your employer’s stock at a discount.

An ESPP allows you to buy your employer’s stock at a discount. Don’t pass up the discount!

What To Do With Stock from an ESPP

Once you purchase company stock at a discount, what do you do with it? Hold it forever? No! Sell it!

Financial planning 101 says:

Don’t put all your eggs in one basket.

All your eggs are in the same basket when you buy (and keep) your employer’s stock. Owning some of your employer’s stock means that both your paycheck and your wealth (investments) are dependent on the same company.

Reduce your risk by selling all of your employer’s stock.

So what do you do? We love reducing risk and we don’t want all our eggs in one basket, but this doesn’t mean we should pass up a good deal. You reduce the risk by buying and then selling the stock.

Our recommendation: Take advantage of your employer’s ESPP and buy company stock at a discount – and then immediately sell it for a profit!

#6: Contribute the Maximum to Your Workplace Retirement Plan

No workplace retirement plan? Skip to the next step of funding a Roth IRA.

If you’ve already managed to accomplish all of the above, great job! Now, we’re onto the next step: maxing out your workplace retirement plan!

If you’re following the steps, you are already contributing the minimum to get your employer match. Your next step is to work towards increasing your contribution to the maximum. Your maximum contribution limit varies by age and plan type. Those under 50 can contribute $22,500 to either their 401(k), 403(b), or 457(b) in 2023. Those age 50+ can contribute an additional $7,500. Some government employees with access to both a 403(b) and 457(b) are eligible to contribute $22,500 to each plan. That means you can put away $45,000 in tax-advantaged money! The maximum contribution to a SIMPLE IRA plan is $15,500 for 2023. Those age 50+ can contribute an additional $3,500.

Review the (Sometimes Hidden) Expenses on Your Workplace Retirement Plan

There is one exception to contributing the maximum dollar amount to your workplace retirement plan: do so only if you’re sure the expenses on your workplace retirement plan are reasonable. Usually, this means having underlying fees (called expense ratios) of less than half a percent (0.5%). The lower the expenses, the better.

Keeping your investment expenses low is critical to investment success.

Most commonly, 403(b)s have high fees. If you’re using a 403(b), get extra familiar with the plan’s expenses.

Regardless of the type of plan, if the expense ratios are higher than 0.5%, you may want to skip to the next step: maxing out an Individual Retirement Arrangement (IRA) account.

Your Workplace Retirement Plan vs. the Roth IRA

Why not skip straight to funding the Roth IRA instead of using your workplace retirement plan? Firstly, you can put a lot more money into a 401(k), 403(b), 457(b), or SIMPLE IRA than you can a traditional or Roth IRA.

Secondly, when you use your workplace retirement plan to save money, you’re taking advantage of automation: money goes into savings directly from your paycheck – before you ever have a chance to spend it. Bonus: Studies have shown automation helps people to save more (another human psychology thing). We’re big fans of automating your savings because it makes saving money easy!

#7: Max Out a Roth IRA

Once you’ve completed the above, contribute the maximum a Roth IRA. (We’re also big fans of Roth IRAs.)

If you earn too much to contribute to a Roth IRA, consider the back-door Roth technique: contribute to a non-deductible IRA and then make a conversion to a Roth IRA. This usually works best when you don’t have any money in traditional, SEP or SIMPLE IRA accounts. Contributing to a traditional IRA or a nondeductible IRA are also good options. However, there are income-based limits on the deductibility of IRA contributions.

Employer Retirement Plan Rollover for a Back-Door Roth Contribution

One option for making a successful back-door Roth contribution is rolling existing traditional IRA (and similar) accounts into an employer’s retirement plan, such as a 401(k), 403(b), and 457(b). This move avoids creating tax consequences during the Roth conversion process.

Spousal IRA

Only employees may contribute to a workplace retirement plan, employee’s spouses cannot.

That’s not the case for IRA accounts. A non-working spouse can contribute to an IRA (so long as the total household contributions to both IRAs do not exceed the household’s taxable income). Contributing to a spousal IRA allows your household to save twice as much money in a tax-advantaged account. Don’t miss this opportunity to save more money!

Mind Your Expenses

As with putting money in your workplace retirement plan, remember to keep your investment expenses (expense ratios) low. A great way to do this is to invest in a low-cost and broadly-diversified index fund.

#8: After-Tax Contributions to Your Workplace Retirement Plan

If you don’t have a workplace retirement account, or if your workplace retirement account doesn’t allow after-tax contributions, skip to the next step of funding a 457(f) plan.

Not all workplace retirement plans allow “after-tax contributions.”

If your employer does offer “after-tax” contributions, and you’ve already checked the box for steps 1-7, then keep shoveling cash into your workplace retirement plan – on an after-tax basis. While you won’t get a tax deduction for your contribution, the contributions will still grow tax-deferred.

After-Tax Contribution Limits to Your 401(k) Plan

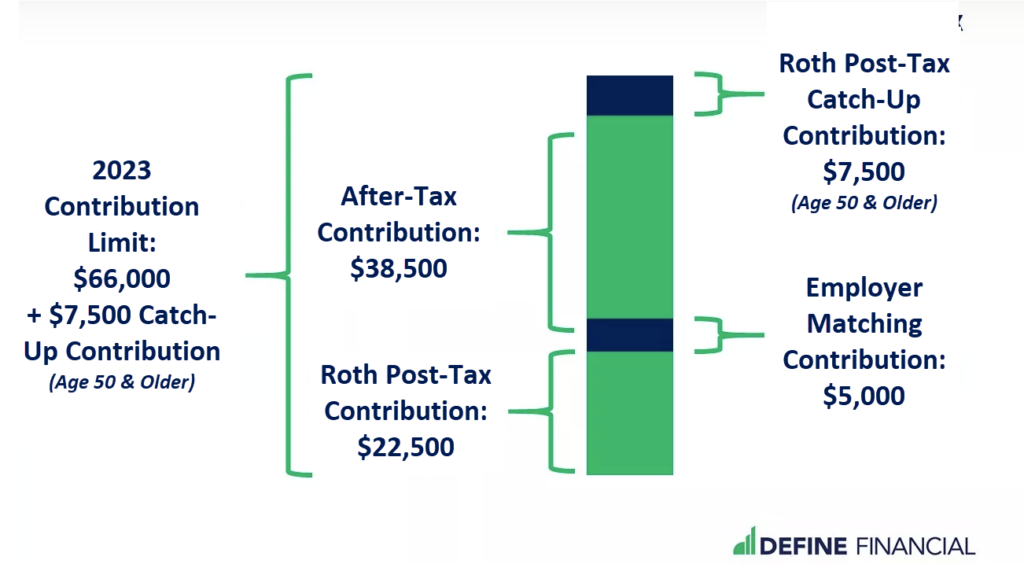

The deferred compensation contribution limit is $66,000 in 2023 for those age 50 and under. Those age 50+ can contribute an additional $7,500. If you’ve already put in the maximum pre-tax contribution of $22,500 into your traditional 401(k) or the maximum post-tax contribution into your Roth 401(k) in step #6, you can still put an additional $43,500 in after-tax dollars into some workplace retirement plans.

Know that after-tax contribution limits are reduced by any employer contributions. If you put $22,500 in your 401(k), and your employer match is $5,000, you can only contribute $38,500 in after-tax dollars to your 401(k).

Mega-Back Door Roth

With money in an after-tax account, you may also have the option to perform a “Mega-Back Door Roth.” With basis in your contributions (since you didn’t take a deduction for your contribution), this “after-tax” money can be converted to “post-tax” money tax-free. This move will allow you to distribute this money – and it’s growth – tax-free in retirement.

Again, the great thing about putting money into your workplace retirement plan is that it takes advantage of the wonderful tool of automation.

Keep your investment expenses low.

Don’t forget, only go with this step once you’ve confirmed that the expenses (expense ratios) in your workplace retirement plan are 0.5% or less. If not, you can skip to the next step.

#9: Deferred Compensation and Executive Savings 457(f) Plans

If you don’t have access to a 457(f) plan, skip to the next step of investing with a taxable account.

One of our last recommendations is to put money into a 457(f) deferred compensation plan. Why did we put this option so low on the list? These plans are riskier because they don’t offer creditor protection. A 401(k), for example, offers creditor protection for money inside the 401(k). Without creditor protection, if the company you’re working for goes bankrupt, any money in a deferred compensation 457(f) plan may be lost.

For this reason, some folks are turned off by executive savings 457(f) plans. After all, who wants to lose their retirement savings because of someone else’s error? That’s why contributing to an executive savings 457(f) plan usually only makes sense when an investor already has enough retirement savings. In this instance, a highly-paid executive may simply be looking to lower their tax bill.

Again with Investment Expenses

As with all workplace retirement plans, remember to consider expenses (expense ratios) before contributing your hard-earned money to an executive savings plan.

#10: Taxable Investment Account with Low-Cost Index Funds

If you’ve run out of tax-advantaged places to put your money, you can always put money into a taxable investment account. Even though you will pay taxes for dividends and capital gains every year, a low-cost, set-it-and-forget-it investment approach can still mean relatively minimal taxes and long-term investment growth.

Make sure to use low-cost index funds – and then leave them alone. Don’t be tempted to tinkle or trade. Just forget about it!

Bonus: Please Don’t Do This with Your Cash

I could list dozens of things not to do with your extra cash, but I’ll leave you with one for today:

Do not buy expensive-but-tax-advantaged investment products.

Permanent life insurance (e.,g, whole life insurance and universal life insurance) and annuities are an example. While the salesperson disguised as a financial advisor may insist otherwise, these products are not a great place for your money.

Of course, there are always exceptions to the above. These types of investments can make sense for a small percentage of savers who have very unique situations.

In Summary: The Best Places to Put Your Money

Congrats! Saving money is a big accomplishment. Now you know how, when, and where to put your extra cash.

No extra cash? No problem.

Learn how to track your spending to start saving more money.

If tracking your spending is too much work for you, then simply focus on your two biggest expenses. Whittle those expenses down to start saving money today!