Recently, I saw a wonderful post on Twitter. It’s too good not to share:

“You can save your way out of an investment mistake. You can’t invest your way out of a savings mistake.” – Tom Conlon

— Dan Egan 🤓 (@daniel_egan) May 1, 2018

This is a fantastic point. It’s such a good point that it deserves a blog post. So, let’s talk about it!

You can’t invest yourself out of a savings hole.

Leave Your Investments Alone!

Anyone who’s spent time reading and learning about investing knows that there’s only so much you can do. That’s because successful investing means following a few simple rules:

- Keep your costs low

- Diversify

- Leave it alone – except to occasionally rebalance.

Moreover, there’s a point at which doing more actually hurts your investments. That’s because making changes, like regularly buying and selling mutual funds, costs money. Said more simply, every time you make a move, it hurts you. The lesson is:

In investing, don’t move.

This is why buy-and-hold investing (using low-cost index funds) is so successful. With this low-maintenance strategy, you get stock market returns without paying a lot for it. (Remember: avoiding fees is important; paying fees lowers your investment return.)

Do less and get more. Don’t fiddle with your investments. Leave them alone!

Of course, you can always try to do better than low-cost, buy-and-hold investing. However, it rarely works. It rarely works because the market is so competitive – filled with brainiac genius investors on the other side of each trade you make. And, of course, there are those pesky fees each time you make a move.

The takeaway is that there’s only so much you can do with your investments – at least successfully.

How Much of a Difference Can Your Investments Make?

For the sake of argument, let’s say you really can get stellar investment returns that are above and beyond average S&P 500 returns. Perhaps you really are a skilled investor. What can that skill do for you?

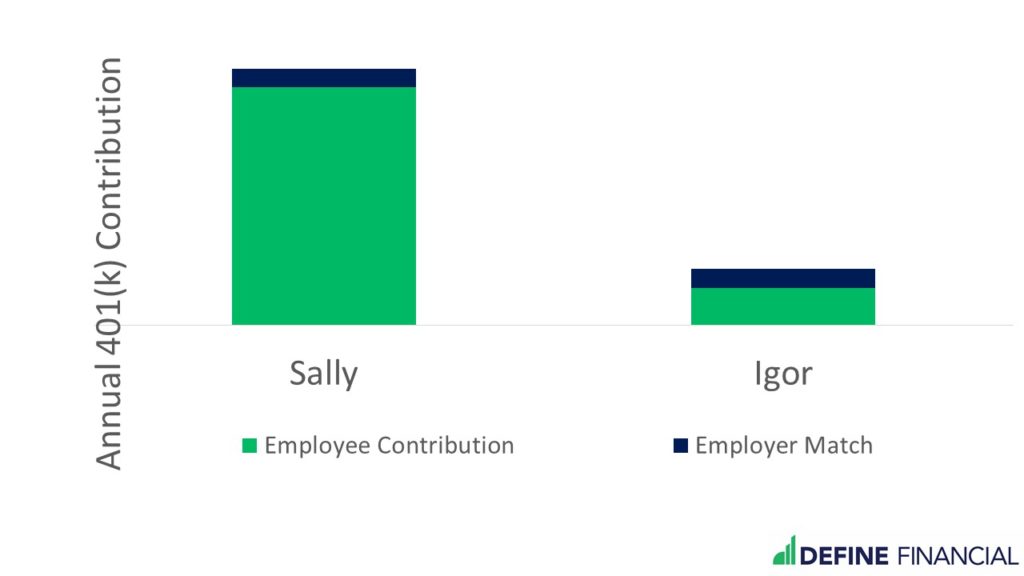

Imagine two investors: Smart-Saver Sally and Impetuous Igor. Both Sally and Igor work at the same company. Their company offers a 50% match on the first $3,000 of 401(k) contributions. Not one to turn down free money, Igor contributes the maximum to get him to the match: $3,000. After the match, Igor is now contributing $4,500 dollars every year into his 401(k) – but nothing more than that.

Smart-Saver Sally similarly decides to take the company up on the match. But instead of investing just the bare minimum of $3,000 for the match, Sally decides to max out her 401(k) every year to the tune of $19,000. Way to go, Sally!

Look at how much more money Sally saves than Igor! Who do you think will have more money in the future?

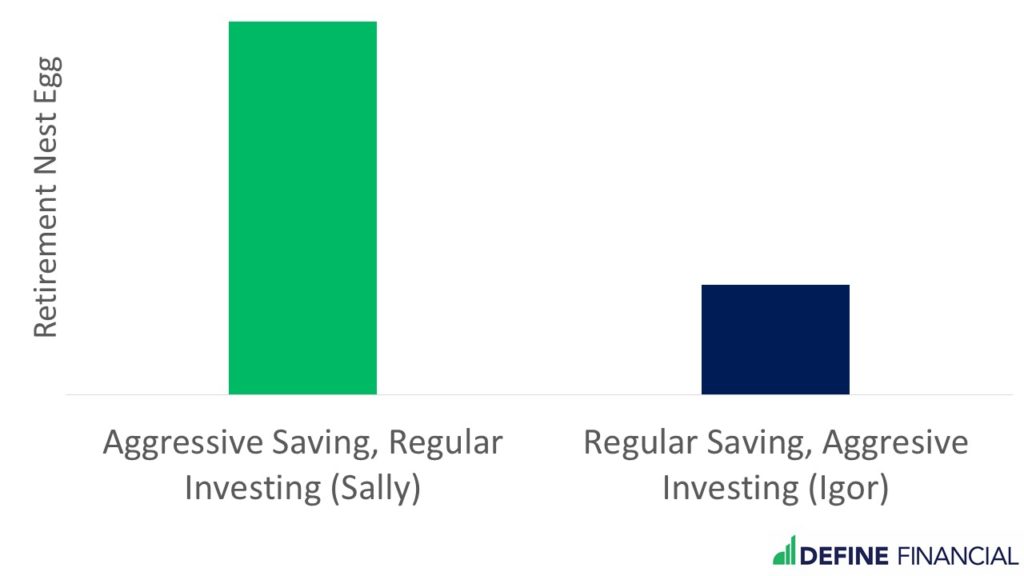

Over the next 25 years, Smart-Saver Sally invests in the S&P 500. She gets a respectable 9.5% investment return. Swinging for the fences, Impetuous Igor chooses the most aggressive investment option possible: a small value mutual fund. The extra risk rewards him handsomely. Igor earned 11.79% over the last 25 years. That’s more than 2% per year over what Smart-Saver Sally. In the world of investing, an extra 2% over 25 years is a very big number. But, keep in mind, Sally invested $19,000 every year, and Igor invested $4,500 each year.

Given their difference in savings and difference in investment returns, who came out ahead? I wouldn’t be writing this post if the answer was obvious. Impetuous Igor came out with a little bit over half a million dollars. Assuming a 3% withdrawal rate, Igor can expect $15,000 in annual income in retirement. That’s not very much. Fortunately, Igor also has Social Security. Between those two things, Igor should be able to get by.

Saving more money makes the biggest difference, way bigger than investing.

How did Smart-Saver Sally do? Her portfolio ended up with more than $1.7 million dollars. Assuming a 3% withdrawal rate, she can expect nearly $51,000 in annual income. That doesn’t even include Social Security.

Even though Smart-Saver Sally earned substantially less in the way of investment return than Impetutous Igor, she came out miles ahead for the simple reason that she saved more money.

Saving More Money Makes the Biggest Difference

Be like Smart-Saver Sally. Save more money and keep your risk in check. Saving more money will guarantee that you will have more money in retirement. Getting high returns and beating the S&P 500 is certainly nice, but saving more money is more important.